South China Sea Dispute: US Business Supply Chain Risks

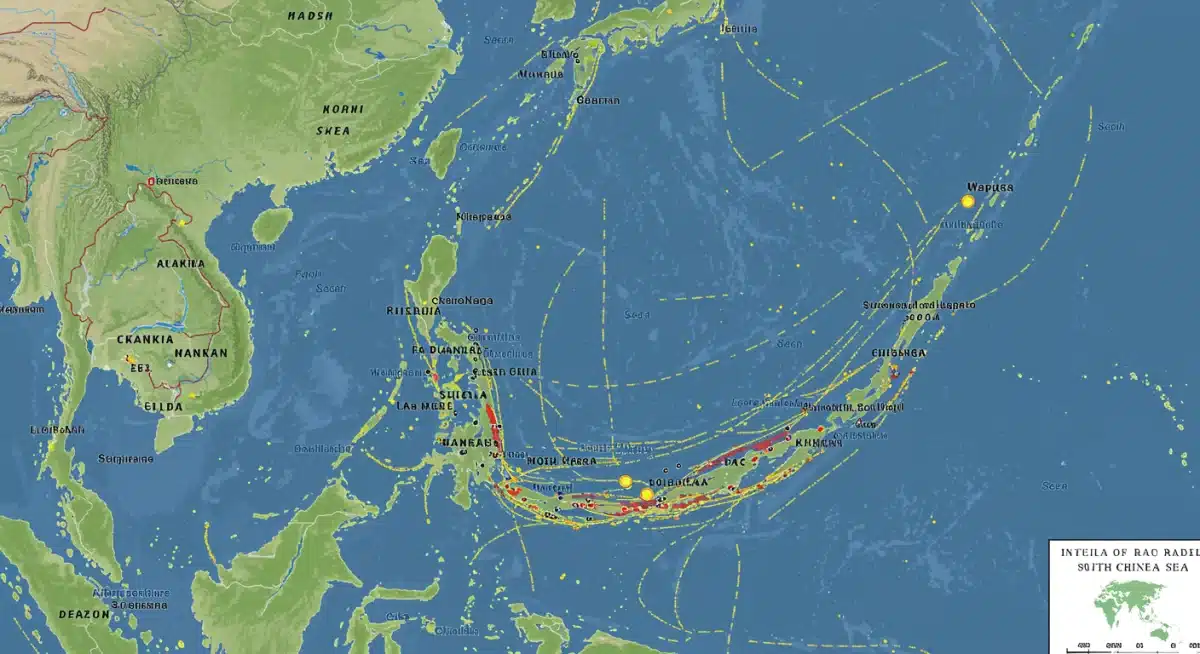

Latest developments in the South China Sea highlight rising geopolitical tensions that could disrupt global trade routes. New updates from officials and analysts are drawing attention from U.S. businesses.

As activity in the South China Sea increases, supply chain risks tied to shipping costs, insurance, and delivery timelines are becoming more pronounced. Understanding these shifts is critical for operational planning.

This report outlines what companies should monitor next regarding the South China Sea. The focus is on verified facts, risk indicators, and practical insights in a clear news-style format.

Understanding the Geopolitical Landscape and its Impact

The South China Sea is a critical waterway, accounting for trillions of dollars in global trade annually. Its strategic importance makes it a flashpoint for territorial disputes involving China, Vietnam, the Philippines, Malaysia, Brunei, and Taiwan.

These ongoing claims and counter-claims create an environment of uncertainty that can quickly escalate. For US businesses, this translates into potential disruptions that are both unpredictable and costly, demanding robust risk mitigation strategies.

The next 12 months are particularly critical as regional powers assert their presence more forcefully. This increased assertiveness directly influences shipping patterns and the operational stability of supply chains reliant on these waters.

Escalating Tensions and Their Direct Consequences

Escalating tensions manifest in various ways, from increased military exercises to diplomatic protests and economic pressures. Each incident, however minor, adds another layer of complexity to the region’s stability.

These developments directly affect shipping insurance premiums and transit times, as carriers seek to navigate perceived risks. Businesses must factor these rising operational costs into their financial planning for the upcoming year.

- Increased naval patrols and military exercises in contested zones.

- Heightened diplomatic rhetoric and potential for miscalculation.

- Impact on maritime law and freedom of navigation assertions.

The cumulative effect of these tensions is a less predictable operating environment for global logistics. US businesses must monitor these shifts closely to anticipate potential bottlenecks and delays.

Navigating Potential Trade and Shipping Disruptions

The reliance of global supply chains on the South China Sea cannot be overstated. A significant portion of container traffic, oil, and gas shipments traverse these waters, making any disruption profoundly impactful.

Potential blockades, naval confrontations, or even increased bureaucratic hurdles could lead to severe delays and rerouting. These scenarios would inevitably drive up costs and extend lead times for goods destined for US markets.

US businesses must assess their exposure to these maritime risks and explore alternative shipping strategies. Diversifying routes and modes of transport, where feasible, becomes a critical consideration in the next 12 months.

Economic Repercussions and Supply Chain Vulnerabilities

The economic repercussions of instability in the South China Sea extend beyond direct shipping costs. Raw material prices, manufacturing schedules, and consumer goods availability are all susceptible to disruption.

Many US companies rely on components and finished products manufactured in Southeast Asia and China, all of which often transit through this region. Any interruption can cascade through their entire supply network.

- Increased freight costs due to longer routes or higher insurance.

- Delays in component delivery impacting manufacturing schedules.

- Potential for product shortages and price volatility for consumers.

Understanding these interconnected vulnerabilities is the first step towards building a more resilient supply chain. Proactive measures are essential to mitigate the financial and reputational damage of such disruptions.

Investment and Manufacturing Relocation Trends

The sustained uncertainty in the South China Sea is influencing long-term investment decisions. Businesses are increasingly looking to diversify their manufacturing bases away from heavily reliant regions.

This trend, often termed “de-risking” or “friend-shoring,” involves relocating production to countries perceived as politically more stable or geographically less exposed. Such shifts carry significant capital expenditure and time.

For US businesses, assessing the viability and benefits of such relocation strategies is a key task for the next 12 months. This involves a careful analysis of costs, infrastructure, and political stability in alternative locations.

Shifting Global Production Footprints

The drive to diversify production is not solely a response to the South China Sea dispute but is certainly accelerated by it. Companies are seeking to reduce their dependence on single points of failure in their global networks.

Governments, including the US, are also encouraging domestic production or sourcing from allied nations. This push for supply chain resilience aligns with national security interests and economic stability.

These shifting production footprints represent a fundamental change in global manufacturing strategy. US businesses must evaluate how these trends align with their long-term operational goals and risk profiles.

- Exploration of manufacturing hubs in India, Mexico, or Eastern Europe.

- Investment in automation and localized production to reduce reliance on distant supply lines.

- Government incentives for reshoring or nearshoring critical industries.

The Role of International Law and Diplomacy

International law, particularly the United Nations Convention on the Law of the Sea (UNCLOS), provides the framework for resolving maritime disputes. However, adherence to these principles remains a contentious issue in the South China Sea.

Diplomatic efforts, often led by the US and its allies, aim to de-escalate tensions and promote peaceful resolutions. These efforts are crucial for maintaining open sea lanes and predictable trade environments.

The efficacy of these international frameworks and diplomatic interventions directly influences the stability of the region. US businesses should monitor the outcomes of these discussions closely, as they can signal future changes in the operating environment.

Challenges to Freedom of Navigation

Freedom of navigation operations (FONOPs) conducted by the US and its allies challenge excessive maritime claims in the South China Sea. These operations aim to uphold international law and ensure unimpeded passage for all vessels.

However, these operations are often met with strong reactions from claimants, particularly China, leading to standoffs and increased military presence. This dynamic adds a layer of complexity and risk for commercial shipping.

For businesses, the ongoing challenges to freedom of navigation underscore the inherent instability. It emphasizes the need for contingency plans that account for potential disruptions to established shipping routes.

Cybersecurity Threats and Digital Infrastructure

Beyond physical disruptions, the South China Sea dispute also amplifies cybersecurity risks for US businesses. Geopolitical tensions often correlate with increased state-sponsored cyber-attacks targeting critical infrastructure and supply chain networks.

Ports, logistics providers, and shipping companies operating in or near the South China Sea are prime targets for cyber espionage or disruptive attacks. Such incidents can cripple operations, leading to significant financial losses and data breaches.

US businesses must bolster their cybersecurity defenses and implement robust incident response plans. Protecting digital infrastructure is as vital as securing physical assets when addressing supply chain risks in this volatile region.

Protecting Digital Supply Chain Operations

The interconnected nature of modern supply chains means a cyber-attack on one link can affect the entire network. This vulnerability is particularly pronounced in regions with heightened geopolitical stress.

Companies need to conduct thorough risk assessments of their digital footprint, including third-party vendors and partners. Ensuring that all elements of the supply chain adhere to strong cybersecurity protocols is paramount.

- Implementing advanced threat detection and prevention systems.

- Regular cybersecurity audits and penetration testing.

- Training employees on best practices for cyber hygiene and recognizing threats.

The integrity of digital supply chain operations is a non-negotiable aspect of risk management. US businesses must invest in comprehensive cybersecurity measures to safeguard against these evolving threats.

Technological Innovation and Risk Mitigation

Technological advancements offer new avenues for mitigating supply chain risks exacerbated by the South China Sea dispute. Data analytics, artificial intelligence, and blockchain can enhance visibility and resilience.

Real-time tracking and predictive analytics allow businesses to anticipate disruptions and reroute shipments proactively. This capability is invaluable in a region prone to sudden geopolitical shifts or natural disasters.

Investing in these technologies can provide US businesses with a competitive edge. It enables them to adapt quickly to unforeseen circumstances and maintain operational continuity despite external pressures.

Leveraging Data for Proactive Supply Chain Management

The ability to collect, analyze, and act on vast amounts of supply chain data is transformative. It moves businesses from reactive problem-solving to proactive risk management, especially concerning the South China Sea.

AI-powered platforms can model various disruption scenarios, helping companies understand potential impacts and pre-plan responses. This foresight is critical for navigating the complexities of the South China Sea.

- Utilizing IoT sensors for real-time cargo tracking and condition monitoring.

- Implementing AI for demand forecasting and inventory optimization.

- Exploring blockchain for secure and transparent supply chain transactions.

By embracing these technological innovations, US businesses can build more robust and intelligent supply chains. This strategic shift is essential for thriving in an increasingly unpredictable global environment.

Insurance and Legal Considerations for Businesses

The complex and evolving nature of the South China Sea dispute necessitates a thorough review of insurance policies. Standard marine cargo insurance may not cover all risks associated with geopolitical conflicts.

Businesses should consult with their legal and insurance advisors to understand the scope of their coverage. Specific war risk clauses, political risk insurance, and force majeure provisions need careful examination.

Understanding these legal and insurance considerations is paramount for US businesses. It ensures they are adequately protected against financial losses arising from unforeseen events in the South China Sea.

Reviewing Contractual Agreements and Liabilities

Existing contracts with suppliers, logistics providers, and customers also need scrutiny. Clauses related to delays, non-performance, and liability in the event of force majeure or geopolitical incidents must be clear.

Renegotiating terms or adding specific provisions to address South China Sea-related risks can provide crucial protection. This proactive legal review minimizes exposure to costly disputes and operational setbacks.

The legal landscape surrounding international trade in contested areas is constantly shifting. Staying informed and adapting contractual agreements is a key aspect of managing the South China Sea Risks.

Government Policies and Business Support

US government policies, including trade agreements, sanctions, and diplomatic initiatives, directly influence the operating environment for businesses in relation to the South China Sea dispute. Staying abreast of these policies is vital.

Government agencies often provide resources, intelligence, and support for businesses navigating complex international environments. These resources can be invaluable for understanding and mitigating South China Sea Risks.

Engaging with relevant government bodies and industry associations can offer US businesses crucial insights and advocacy. This collaborative approach strengthens collective resilience against geopolitical challenges.

Leveraging Official Guidance and Resources

Official guidance from the Department of Commerce, State Department, and other agencies provides critical information on geopolitical developments and potential business impacts. These resources can help shape corporate strategies.

Trade associations and industry groups also serve as important conduits for information sharing and best practices. Participating in these networks fosters a collective response to shared challenges in the South China Sea.

- Monitoring US government advisories and travel warnings for the region.

- Participating in industry working groups focused on supply chain resilience.

- Seeking expert advice on compliance with international trade regulations.

By actively engaging with these governmental and industry resources, US businesses can better position themselves to manage the complexities of the South China Sea dispute and its associated supply chain risks.

| Key Aspect | Business Implication |

|---|---|

| Geopolitical Tensions | Increased shipping costs, potential delays, and rerouting. |

| Supply Chain Vulnerabilities | Risk of component shortages, manufacturing disruptions. |

| Manufacturing Relocation | Long-term shift in production, requiring strategic investment. |

| Cybersecurity Threats | Enhanced risk of cyber-attacks on logistics and data. |

Frequently Asked Questions About South China Sea Risks

Geopolitical tensions can increase shipping costs through higher insurance premiums, potential rerouting to avoid contested areas, and longer transit times. Uncertainty often leads carriers to impose surcharges, impacting US businesses relying on these routes.

Businesses can diversify sourcing, explore alternative shipping routes, invest in supply chain visibility technology, and review insurance policies. Establishing contingency plans and maintaining close communication with logistics partners are also crucial for managing South China Sea Risks.

Yes, manufacturing relocation to more stable regions or closer to home (nearshoring/reshoring) is a growing trend. While it involves significant investment and time, it can reduce long-term exposure to geopolitical risks in the South China Sea and enhance supply chain resilience.

Heightened geopolitical tensions often lead to increased state-sponsored cyber-attacks targeting critical infrastructure, including shipping and logistics. US businesses with operations or partners in the region face elevated risks of data breaches and operational disruptions, directly tied to South China Sea Risks.

The US government provides advisories, intelligence, and diplomatic support to promote stability and freedom of navigation. Agencies like the Department of Commerce offer resources and guidance to help US businesses understand and navigate the complex supply chain risks associated with the South China Sea dispute.

Next Steps

The evolving situation in the South China Sea demands continuous vigilance and strategic adaptation from US businesses.

Monitoring geopolitical developments, reviewing and diversifying supply chain strategies, and leveraging technological solutions are paramount.

Proactive engagement with government resources and industry insights will be crucial for navigating The South China Sea Dispute: What US Businesses Need to Know About Supply Chain Risks in the Next 12 Months effectively and minimizing potential disruptions to global trade and operations.