International Tax Agreements: U.S. Corporate Earnings Impact in 2025

New international tax agreements, particularly those spearheaded by the OECD, are poised to significantly impact U.S. corporate earnings, with projections suggesting a potential reduction of up to 15% by 2025 due to shifts in profit allocation and minimum tax rates.

The global economic landscape is constantly evolving, and with it, the rules governing international taxation. For U.S. corporations, upcoming international tax agreements could usher in a new era of fiscal challenges, potentially reducing their earnings by a substantial 15% by 2025. This isn’t merely a minor adjustment; it’s a significant shift that demands immediate attention and strategic planning from businesses across various sectors.

Understanding the New International Tax Landscape

The world of international taxation is undergoing its most significant transformation in decades. Driven by concerns over tax avoidance and the fair distribution of tax revenues in an increasingly digitalized global economy, international bodies like the Organization for Economic Co-operation and Development (OECD) have been working tirelessly to establish new frameworks. These frameworks aim to ensure that multinational enterprises (MNEs) pay their fair share of taxes where they generate profits, rather than shifting them to low-tax jurisdictions.

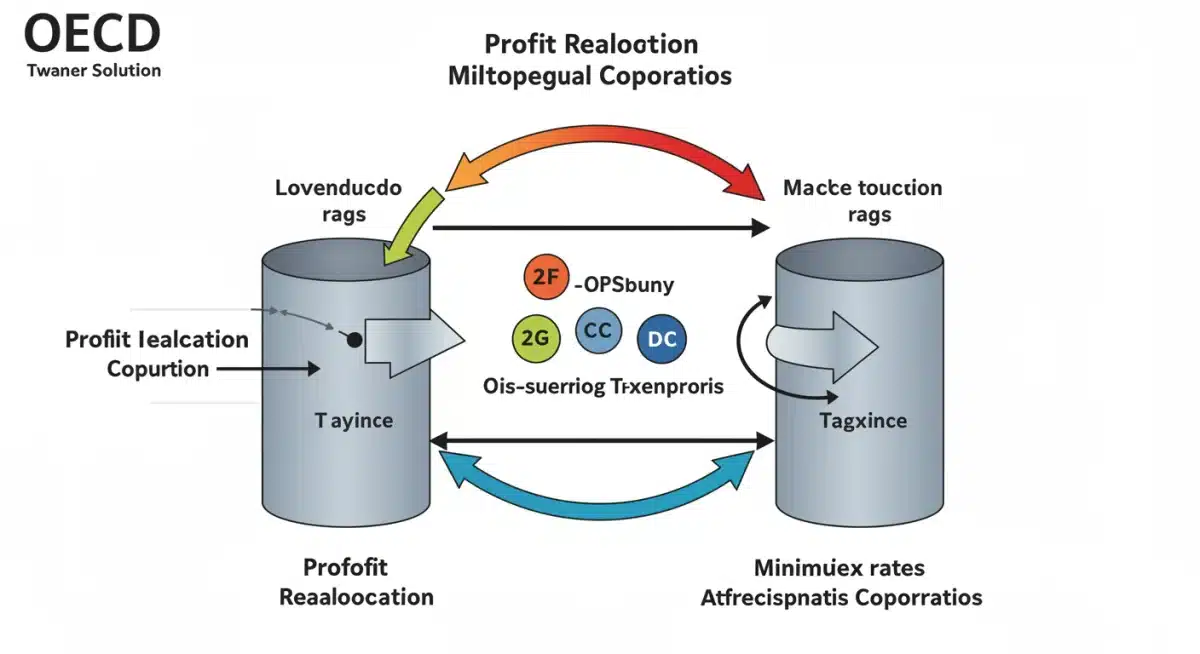

At the heart of these changes is the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS 2.0), which proposes a two-pillar solution. Pillar One focuses on the reallocation of taxing rights to market jurisdictions, meaning countries where MNEs have sales and users, regardless of physical presence. Pillar Two introduces a global minimum corporate tax rate, ensuring that large MNEs pay at least a certain level of tax on their profits, irrespective of where they are headquartered or operate.

The Genesis of Global Tax Reform

The push for these reforms gained significant momentum following years of public and political outcry over perceived tax avoidance by large technology companies and other MNEs. Governments worldwide recognized that existing tax rules, designed for a less digitized economy, were no longer fit for purpose. The goal is to create a more stable and predictable international tax system that addresses the challenges of globalization and digitalization.

- Addressing digitalization: Old tax rules struggled to capture value created digitally.

- Curbing profit shifting: MNEs exploited loopholes to move profits to low-tax havens.

- Ensuring fairness: Public pressure demanded a more equitable distribution of tax revenues.

- Promoting stability: A new framework aims to reduce tax disputes and uncertainty.

These initiatives are not just theoretical constructs; they are rapidly becoming concrete policies adopted by countries around the globe. For U.S. corporations, this means a fundamental re-evaluation of their current tax structures and a proactive approach to understanding the implications of these global shifts. The impact on margins and profitability could be substantial, requiring careful navigation.

Pillar One: Reallocating Taxing Rights and Its Impact

Pillar One of the OECD’s BEPS 2.0 initiative represents a radical departure from traditional international tax principles. Historically, a company’s taxable presence was largely determined by its physical presence in a country. Pillar One introduces the concept of ‘Amount A,’ which reallocates a portion of the residual profits of the largest and most profitable MNEs to market jurisdictions where they have sales, even without a physical presence.

This reallocation is particularly significant for U.S. technology giants and consumer-facing businesses that generate substantial revenue from users and customers globally but might have limited physical operations in those markets. The aim is to ensure that these market jurisdictions receive a share of the profits generated within their borders, reflecting the value created by their consumer base.

Who is Affected by Amount A?

Amount A applies to MNEs with global revenues exceeding €20 billion and a profit margin above 10%. A percentage of their residual profit (profit exceeding 10% of revenue) will be reallocated to market jurisdictions. This means that U.S. companies meeting these thresholds will likely see a portion of their profits taxed in other countries, reducing the taxable base in the U.S.

- High-revenue MNEs: Companies with global revenues over €20 billion.

- High-profitability: Those with a profit margin exceeding 10%.

- Consumer-facing businesses: Especially those heavily reliant on digital interaction.

- Digital service providers: Tech companies with global user bases.

The implications for U.S. corporate earnings are multifaceted. While the U.S. may gain some taxing rights over foreign MNEs operating within its borders, the net effect for many U.S.-headquartered multinationals is expected to be a reduction in their overall taxable income in the U.S. This shift could necessitate significant adjustments in financial forecasting and tax planning strategies, potentially leading to a direct impact on bottom lines.

Pillar Two: The Global Minimum Tax Rate

Pillar Two, often referred to as the Global Anti-Base Erosion (GloBE) rules, establishes a global minimum corporate tax rate of 15% for large MNEs. This is designed to deter profit shifting to low-tax jurisdictions and ensure that all large MNEs pay at least the minimum effective tax rate on their profits, regardless of where they are booked. The rules apply to MNEs with annual revenues exceeding €750 million.

The mechanism works through a series of interlocking rules. If an MNE’s profits in a particular jurisdiction are taxed below the 15% minimum rate, other jurisdictions where the MNE operates can apply a ‘top-up tax’ to bring the effective tax rate up to 15%. This means that even if a U.S. corporation operates subsidiaries in a country with a statutory tax rate below 15%, those profits could still be subject to a higher overall tax burden.

Key Components of Pillar Two

Pillar Two introduces several complex components that U.S. corporations must navigate. The primary mechanisms are the Income Inclusion Rule (IIR) and the Undertaxed Profits Rule (UTPR).

- Income Inclusion Rule (IIR): This rule allows the parent company’s jurisdiction to impose a top-up tax on the low-taxed profits of its foreign subsidiaries.

- Undertaxed Profits Rule (UTPR): If the IIR doesn’t apply (e.g., if the parent jurisdiction hasn’t implemented it), the UTPR allows other jurisdictions where the MNE operates to deny deductions or make other adjustments to collect the top-up tax.

- Qualified Domestic Minimum Top-up Tax (QDMTT): Some countries may implement a domestic minimum tax that aligns with the GloBE rules, allowing them to collect the top-up tax themselves rather than having it collected by other countries.

For U.S. corporations, this implies a potential increase in their global effective tax rates, particularly for those with operations in historically low-tax jurisdictions. The interplay between U.S. tax laws and these new global rules will be critical, as companies assess how existing tax credits and deductions might be affected. The projected 15% reduction in U.S. corporate earnings by 2025 is a direct reflection of these increased tax liabilities and the complexities involved in compliance.

Projected 15% Impact on U.S. Corporate Earnings by 2025

The projection of a 15% reduction in U.S. corporate earnings by 2025 due to these international tax agreements is a significant figure that demands thorough analysis. This estimate stems from various factors, including the reallocation of taxing rights under Pillar One, the increased tax burden from the global minimum tax under Pillar Two, and the associated compliance costs and strategic adjustments required.

Firstly, the reallocation of profits to market jurisdictions means that a portion of the profits previously taxed in the U.S. will now be taxed elsewhere, directly reducing the U.S. tax base for affected corporations. Secondly, companies with operations in low-tax jurisdictions will face higher effective tax rates due to the 15% global minimum tax, eroding the benefits of previous tax planning strategies. This will directly translate to lower net income.

Factors Contributing to the Earnings Reduction

Several intertwined factors contribute to this projected decline. It’s not a single-point impact but a confluence of regulatory changes and market responses.

- Reduced U.S. tax base: Profits reallocated under Pillar One mean less taxable income in the U.S. for some MNEs.

- Increased global effective tax rates: Pillar Two ensures companies pay at least 15%, eliminating advantages of very low-tax jurisdictions.

- Compliance and administrative costs: Adapting to complex new rules requires substantial investment in tax technology, personnel, and advisory services.

- Strategic shifts: Companies may need to restructure operations or supply chains, incurring costs.

- Uncertainty and volatility: The transitional period may bring market jitters and cautious investment.

The 15% figure is an aggregate estimate, and the actual impact will vary significantly among individual companies depending on their size, industry, geographic footprint, and current tax structures. Companies with extensive international operations and those currently benefiting from very low-tax regimes are likely to experience a more pronounced effect. Businesses must model these potential impacts meticulously to prepare for the fiscal shifts of 2025.

Strategic Responses for U.S. Corporations

In the face of these impending changes, U.S. corporations cannot afford to be passive. Proactive and strategic responses are essential to mitigate the potential 15% earnings reduction and maintain competitiveness. This involves a comprehensive review of current tax strategies, operational structures, and investment plans.

One primary response is to undertake a detailed impact assessment. Companies need to model how Pillar One and Pillar Two will specifically affect their individual tax liabilities and effective tax rates across all jurisdictions. This granular understanding is crucial for identifying areas of exposure and opportunity. Furthermore, companies should engage in robust scenario planning to understand the range of potential outcomes and develop contingency plans.

Key Strategic Adjustments

Adapting to the new international tax agreements requires more than just tax department adjustments; it involves a holistic business approach.

- Re-evaluating supply chains: Optimizing supply chain locations and legal entity structures to align with new profit allocation rules.

- Digital transformation of tax functions: Investing in advanced tax technology and data analytics to handle increased reporting and compliance requirements.

- Engaging with policymakers: Participating in consultations and providing feedback on the implementation of these rules to help shape future guidance.

- Reviewing transfer pricing policies: Ensuring intercompany transactions are robust and defensible under the new regime.

- Talent development: Training tax and finance teams on the complexities of BEPS 2.0 and building internal expertise.

Beyond internal adjustments, U.S. corporations should also consider the broader implications for their investment strategies and market positioning. Companies might need to reassess the attractiveness of certain foreign markets or reconsider their global expansion plans. Ultimately, a flexible and informed approach will be key to navigating these complex changes and preserving shareholder value. The goal is not just compliance, but strategic adaptation to a new global financial reality.

The Role of U.S. Tax Policy and International Relations

The implementation of these international tax agreements is not solely dependent on the OECD; it also heavily relies on the legislative actions of individual countries, including the United States. The U.S. government’s stance and its domestic tax policy responses will play a pivotal role in shaping the final impact on U.S. corporate earnings. There’s a delicate balance to strike between supporting global tax reform efforts and protecting the competitiveness of American businesses.

Currently, the U.S. has its own set of international tax rules, such as GILTI (Global Intangible Low-Taxed Income) and FDII (Foreign-Derived Intangible Income), which aim to address similar issues. The challenge lies in integrating these existing U.S. rules with the new global framework without creating undue complexity or double taxation. Congressional action will be required to align U.S. tax law with the Pillar One and Pillar Two agreements, and the specifics of this legislation will be critical.

Navigating the Diplomatic and Legislative Maze

The process of incorporating these international agreements into U.S. law is fraught with complexities, requiring careful consideration of various stakeholder interests.

- Congressional approval: Any significant changes to U.S. tax law will require legislative action, which can be a lengthy and politically charged process.

- Alignment with existing laws: Ensuring GILTI and other U.S. international tax provisions work seamlessly with the new global rules.

- Protecting U.S. competitiveness: Policymakers must weigh the benefits of global tax harmonization against potential disadvantages for U.S. companies.

- Bilateral tax treaties: Re-evaluating and potentially renegotiating existing bilateral tax treaties to avoid conflicts with the new multilateral framework.

- Industry lobbying: U.S. corporations and industry groups will actively lobby Congress to ensure their interests are represented in any new legislation.

The outcome of these legislative and diplomatic efforts will directly influence the net impact on U.S. corporate earnings. A well-designed U.S. implementation strategy could help smooth the transition and minimize adverse effects, while a disjointed approach could exacerbate the challenges. Continuous engagement between corporations and policymakers will be essential to foster an environment that supports both global tax fairness and robust U.S. economic growth.

Long-Term Implications Beyond 2025

While the immediate focus is on the projected 15% impact on U.S. corporate earnings by 2025, the long-term implications of these international tax agreements extend far beyond that horizon. These reforms are not a one-off event but rather the beginning of a new era in global tax governance. Corporations must consider how these changes will reshape the competitive landscape, influence investment decisions, and redefine the very nature of international business operations for decades to come.

In the long run, the new framework aims to create a more level playing field, reducing the incentive for companies to base decisions on tax arbitrage alone. This could shift the focus back to fundamental economic factors such as market access, talent availability, and infrastructure quality when choosing where to invest and operate. However, it also introduces a new layer of complexity that will require continuous monitoring and adaptation.

Redefining Global Business Strategies

The ripple effects of these tax changes will touch every aspect of international business, prompting a re-evaluation of long-held strategies.

- Investment allocation: Capital may flow more towards jurisdictions with stable regulatory environments and strong economic fundamentals, rather than just low tax rates.

- Mergers and acquisitions: Tax due diligence in M&A transactions will become even more critical, with a focus on target companies’ exposure to Pillar One and Pillar Two.

- Digital economy evolution: The taxation of digital services will continue to be a focal point, potentially leading to further refinements of the rules.

- Increased transparency: Greater reporting requirements and data exchange among tax authorities will foster a more transparent global tax environment.

- Enhanced tax disputes: While designed to reduce disputes, the initial implementation phase may see an uptick in disagreements between MNEs and tax authorities.

Ultimately, the long-term success for U.S. corporations will depend on their ability to integrate these new tax realities into their core business strategies. This means fostering a culture of continuous learning and adaptation within their tax and finance functions, while also engaging proactively with external stakeholders. The future of international business will be characterized by greater tax scrutiny, increased compliance burdens, and a strategic imperative to build resilient and adaptable global operating models.

| Key Point | Brief Description |

|---|---|

| Pillar One: Amount A | Reallocates taxing rights for large MNEs’ residual profits to market jurisdictions, impacting U.S. tech and consumer companies. |

| Pillar Two: Global Minimum Tax | Establishes a 15% minimum corporate tax rate for MNEs, reducing benefits of low-tax jurisdictions. |

| Projected 15% Earnings Impact | Combined effect of Pillars One and Two could significantly reduce U.S. corporate earnings by 2025. |

| Strategic Corporate Response | Companies must re-evaluate tax strategies, supply chains, and invest in compliance technology to adapt. |

Frequently asked questions about international tax agreements

The primary drivers are the digitalization of the global economy and concerns over corporate tax avoidance. Governments sought ways to ensure multinational enterprises pay their fair share of taxes where they generate profits, updating outdated tax rules designed for a less digital world.

Pillar One’s ‘Amount A’ reallocates a portion of residual profits from large, highly profitable MNEs to market jurisdictions. This particularly impacts U.S. technology companies with significant global user bases but limited physical presence, potentially increasing their tax liability in foreign markets.

The 15% global minimum tax rate under Pillar Two aims to prevent companies from shifting profits to low-tax jurisdictions. It ensures that large MNEs pay at least this rate, reducing tax competition among countries and potentially increasing the overall tax burden for corporations operating in historically low-tax regions.

U.S. corporations should conduct detailed impact assessments, re-evaluate global supply chains, invest in tax technology for compliance, and engage with policymakers. Proactive planning and strategic adjustments to operational and financial structures are crucial to mitigate potential negative impacts.

While the agreements aim to reduce double taxation through coordination, the initial implementation phase could present challenges. The U.S. government will need to align its domestic tax laws with the new global framework to minimize potential conflicts and ensure seamless integration.

Conclusion

The advent of new international tax agreements represents a paradigm shift in global corporate taxation, with significant implications for U.S. corporate earnings. The projected 15% reduction by 2025 is a stark reminder that businesses must adapt swiftly and strategically to this evolving landscape. Navigating Pillar One’s profit reallocation and Pillar Two’s global minimum tax rate demands meticulous planning, technological investment, and a proactive engagement with both internal operations and external policy discussions. While the transition may be complex, a well-informed and agile approach will be crucial for U.S. corporations to maintain their competitiveness and ensure sustainable growth in this new global fiscal reality.