U.S. Federal Grants for Small Businesses 2025: A 7-Step Guide

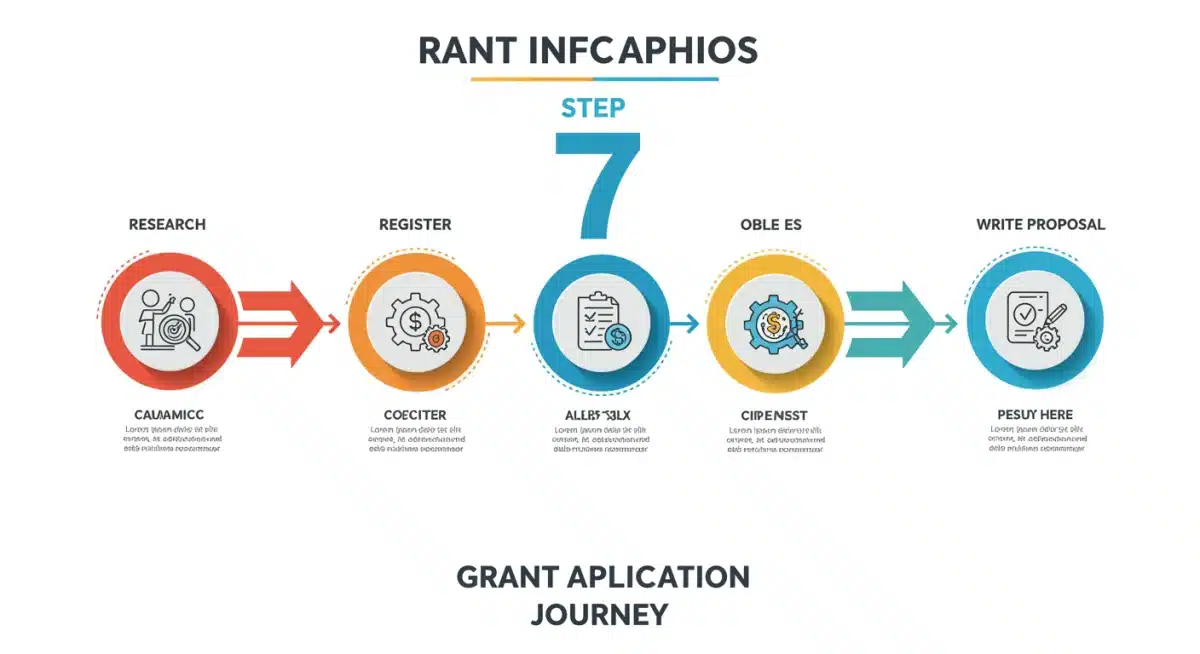

Securing U.S. federal grants in 2025 for small businesses involves a structured 7-step application process, requiring thorough preparation, strategic planning, and meticulous submission to unlock vital funding opportunities.

Navigating the landscape of federal funding can be a game-changer for small businesses across the United States. This comprehensive GUIDE: Securing U.S. Federal Grants for Small Businesses in 2025: A 7-Step Application Process is designed to demystify the journey, providing actionable insights and a clear roadmap for entrepreneurs aiming to access this often-underutilized resource. Understanding the nuances of federal grants is not merely about finding money; it’s about strategically aligning your business goals with national priorities, fostering innovation, and driving economic growth.

Understanding the Federal Grant Landscape for Small Businesses

The federal government is a significant source of funding for small businesses, primarily through agencies like the Small Business Administration (SBA), the Department of Energy, and the National Institutes of Health. These grants are not loans; they do not need to be repaid, making them incredibly attractive. However, they are highly competitive and come with stringent requirements. The purpose of these grants is often to stimulate economic development, encourage innovation, support specific industries, or address societal challenges.

Many small businesses mistakenly believe federal grants are only for large corporations or groundbreaking scientific research. While some grants do target these areas, a substantial portion is allocated to small businesses, especially those engaged in research and development, technology innovation, or projects that create jobs and benefit local communities. Knowing where to look and understanding the government’s priorities are crucial first steps.

Types of Federal Grants Available

Federal grants are broadly categorized, but for small businesses, the most common types include:

- Small Business Innovation Research (SBIR) Grants: These grants fund small businesses engaged in federal research and development with commercialization potential.

- Small Business Technology Transfer (STTR) Grants: Similar to SBIR, but requires formal collaboration with a non-profit research institution.

- Community Development Grants: Often aimed at businesses that contribute to economic development in specific distressed communities.

- Specific Industry Grants: Tailored for sectors such as agriculture, renewable energy, or healthcare, supporting innovation and growth within these fields.

Each grant program has unique objectives, eligibility criteria, and application procedures. It’s vital to identify which programs align best with your business’s mission and capabilities. The federal government’s fiscal year runs from October 1 to September 30, and grant opportunities are announced throughout the year, so staying informed is key.

Understanding the federal grant landscape is the foundational step in this journey. It involves discerning the various types of grants, identifying the agencies that offer them, and grasping the underlying objectives the government aims to achieve through these funding opportunities. This initial research helps small businesses narrow down their focus and pursue grants that genuinely fit their profile and project scope.

Step 1: Research and Identify Suitable Grant Opportunities

The first critical step in securing federal grants is thorough research to identify opportunities that align with your business. This isn’t just about finding any grant; it’s about finding the right grant. The federal government has thousands of programs, and sifting through them requires a systematic approach. Begin by visiting official government websites dedicated to grants.

Grants.gov is the primary federal portal for finding and applying for federal grants. It aggregates grant opportunities from over 1,000 federal grant programs across 26 federal agencies. Sam.gov is another essential resource, particularly for federal contracting, but it also lists some grant opportunities and is crucial for registration purposes. You should also explore individual agency websites, such as the Department of Commerce, Department of Defense, or the National Science Foundation, as they often provide more detailed information about their specific grant programs.

Effective Grant Search Strategies

When searching, use keywords related to your industry, business type, project scope, and technological focus. Don’t limit yourself to obvious terms; think broadly about the societal problems your business might address or the innovative solutions it offers. Look for grants that specifically mention small businesses, underserved communities, or particular demographic groups if your business falls into those categories.

- Use advanced search filters: Grants.gov allows filtering by agency, category, eligibility, and funding instrument type.

- Subscribe to alerts: Set up email notifications for new grant postings that match your criteria.

- Review past awards: Examining previously awarded grants can give you insight into what types of projects and businesses federal agencies prefer to fund.

Beyond the primary search, consider joining relevant industry associations or local small business development centers (SBDCs). These organizations often have staff dedicated to helping businesses find funding opportunities and can provide valuable insights and connections. They might also host workshops or webinars on grant writing and application processes.

This initial research phase is paramount. It involves not just discovering available grants but meticulously vetting them against your business’s mission, capacity, and project viability. A well-targeted search saves time and increases the likelihood of finding a grant for which your business is genuinely competitive, setting a strong foundation for the subsequent application steps.

Step 2: Determine Eligibility and Understand Requirements

Once you’ve identified potential grant opportunities, the next crucial step is to meticulously determine your eligibility and fully understand the specific requirements of each program. Many promising applications are rejected simply because the applicant failed to meet a specific criterion or overlooked a critical instruction. This stage demands careful attention to detail.

Each Notice of Funding Opportunity (NOFO) or Request for Applications (RFA) document must be read thoroughly. These documents outline everything from the purpose of the grant to the types of projects funded, eligible applicants, required forms, submission deadlines, and evaluation criteria. Pay close attention to sections detailing business size standards, operational history, geographic location, and specific project outcomes.

Key Eligibility Factors to Scrutinize

Common eligibility factors for small businesses include:

- Business size: Defined by the SBA, usually based on revenue or number of employees, varying by industry.

- Business type: For-profit, non-profit, educational institution, etc.

- Project alignment: How well your proposed project aligns with the grant’s stated objectives and national priorities.

- Financial standing: Some grants may require a demonstrated history of financial stability or co-funding.

Beyond these, look for any specific technical or operational requirements. For example, a technology grant might require your business to have proprietary intellectual property or a proven track record in a specific scientific field. A grant focused on community development might require demonstrating local impact or partnerships with community organizations.

It’s also important to understand the reporting and compliance requirements that come with federal grants. These are not just about receiving the money; they are about accountability for how the funds are used. Be prepared for detailed financial tracking, performance reporting, and potential audits. If any requirement seems unclear, do not hesitate to contact the grant-making agency directly for clarification. This proactive approach can prevent costly mistakes and ensure your application is compliant from the outset.

Thoroughly assessing eligibility and comprehending all requirements is a non-negotiable step. It ensures that the effort invested in the application process is well-placed, targeting only those opportunities where your business genuinely stands a chance. This meticulous review prevents frustration and wasted resources, channeling your focus towards viable funding paths.

Step 3: Register Your Business with Necessary Federal Systems

Before you can even begin to apply for most federal grants, your small business must be properly registered with several federal systems. This bureaucratic but essential step ensures transparency, accountability, and facilitates the transfer of funds. It’s often a time-consuming process, so starting early is highly recommended, as delays here can easily cause you to miss application deadlines.

The primary registration point is the System for Award Management (SAM.gov). SAM.gov is the official U.S. government system that consolidates federal procurement and award data. Every entity wishing to do business with the federal government, including applying for grants, must have an active registration here. Your SAM.gov registration will generate a Unique Entity Identifier (UEI), which is universally required for federal award applications.

Essential Federal Registrations

The key registrations and identifiers include:

- Unique Entity Identifier (UEI): Replaced the DUNS number. Automatically assigned when registering in SAM.gov.

- SAM.gov Registration: Requires detailed business information, including financial, organizational, and operational data. Ensure your registration is active and renewed annually.

- Grants.gov Registration: Once you have a UEI and active SAM.gov registration, you can register on Grants.gov. This links your business to the application portal.

- Agency-Specific Registrations: Some agencies may require additional registrations on their own platforms, particularly for scientific or highly specialized grants.

The SAM.gov registration process can take several weeks, sometimes longer if there are discrepancies or if additional documentation is requested. It involves validating your business information with various government databases. Be prepared to provide your Taxpayer Identification Number (TIN), bank account information for direct deposit, and other legal and financial details. Accuracy is paramount; any errors can lead to significant delays or even rejection of your application.

Beyond initial registration, it’s crucial to maintain these registrations. SAM.gov registrations, for instance, must be renewed annually to remain active. Failing to keep your registrations current means you cannot apply for grants or receive funds. Plan to review and update your information regularly, especially as your business evolves or its leadership changes. This administrative diligence is as important as the grant writing itself.

Proper and timely registration with federal systems is a foundational requirement, not an optional step. It demonstrates your business’s legitimacy and readiness to engage with federal funding mechanisms. By completing this stage meticulously, you establish the necessary infrastructure for a smooth application process, avoiding last-minute hurdles that could jeopardize your grant prospects.

Step 4: Develop a Compelling Project Proposal

With eligibility confirmed and registrations complete, the core of your grant application lies in developing a compelling project proposal. This document is your opportunity to convince the funding agency that your project is not only viable but also uniquely suited to achieve the grant’s objectives. A strong proposal is clear, concise, well-researched, and persuasive, articulating both the problem and your innovative solution.

Start by thoroughly understanding the grant’s scope of work and evaluation criteria. These are usually detailed in the NOFO or RFA. Your proposal should directly address each point, demonstrating how your project meets or exceeds the expectations. Think of it as a detailed blueprint of your project, designed to answer every question an evaluator might have.

Elements of a Strong Proposal

- Executive Summary: A concise overview of your project, its goals, methods, and expected outcomes. This is often the first, and sometimes only, section evaluators read in detail initially.

- Problem Statement: Clearly define the problem your project aims to solve, supported by data and evidence.

- Project Description/Goals: Detail your proposed solution, specific objectives, and how they align with the grant’s mission.

- Methodology: Explain your approach, activities, timeline, and resources needed. Be specific and realistic.

- Budget: A detailed breakdown of how grant funds will be used, justifying each expense.

- Organizational Capacity: Highlight your team’s expertise, past achievements, and resources that make your business capable of executing the project.

- Evaluation Plan: Describe how you will measure success and track progress towards your objectives.

Storytelling plays a significant role in grant writing. While data and facts are essential, weaving them into a narrative that highlights the impact and innovation of your project can make your application stand out. Emphasize the broader benefits of your project—how it will contribute to economic growth, job creation, technological advancement, or community well-being. Quantify these impacts whenever possible.

Seek feedback on your proposal from trusted advisors, mentors, or even colleagues who are not directly involved in the project. A fresh pair of eyes can catch errors, identify areas of confusion, or suggest improvements. Many SBDCs offer proposal review services, which can be invaluable. Remember, a compelling proposal is not just about what you plan to do, but why it matters and how you will ensure its success.

Crafting a compelling project proposal is where strategy meets substance. It requires a deep understanding of the grant’s objectives, meticulous planning, and the ability to articulate your vision with clarity and conviction. A well-written proposal serves as the cornerstone of your entire application, making a persuasive case for why your small business deserves federal funding.

Step 5: Prepare a Detailed and Justified Budget

A well-constructed budget is as crucial as the narrative portion of your grant proposal. It demonstrates fiscal responsibility and a clear understanding of the resources required to achieve your project objectives. A detailed and justified budget instills confidence in evaluators that you can manage federal funds effectively and deliver on your promises. This section is not merely a list of expenses; it’s a financial roadmap that complements your project plan.

Start by itemizing every anticipated expense related to your project. This includes personnel salaries, equipment purchases, travel costs, supplies, contractual services, and indirect costs. For each item, provide a clear justification explaining why it is necessary for the project’s success. Avoid padding the budget, but also ensure you haven’t underestimated costs, which could jeopardize project completion.

Budgetary Considerations and Best Practices

- Personnel Costs: List names/titles, roles, time commitment (e.g., FTE percentage), and salary/wage rates. Justify why each position is critical.

- Equipment and Supplies: Specify items, quantities, unit costs, and their direct relevance to project activities.

- Travel: Detail purpose, number of travelers, destinations, and estimated costs for transportation and lodging.

- Indirect Costs: Understand the federal guidelines for indirect costs (e.g., administrative overhead, utilities). If you have a negotiated indirect cost rate agreement (NICRA), include it. If not, agencies often allow a de minimis rate of 10% of modified total direct costs (MTDC).

- Cost Sharing/Matching: Some grants require your business to contribute a portion of the project costs. Clearly delineate these contributions, whether they are cash or in-kind.

Make sure your budget aligns perfectly with the activities described in your project proposal. If your proposal mentions hiring a new researcher, that position should appear in the personnel section of your budget. Discrepancies between the narrative and the budget can raise red flags for evaluators. Use the specific budget forms or templates provided by the granting agency, as these often have predefined categories and formats.

It’s also advisable to include a budget narrative or justification document. This narrative provides additional detail and explanation for each line item, further demonstrating the reasonableness and necessity of your proposed expenditures. Explain any assumptions made in your cost estimates and clarify how you arrived at specific figures. Transparency and thoroughness are key to a successful budget submission.

A meticulously prepared budget is a testament to your business’s planning capabilities and financial acumen. It validates the feasibility of your project and assures funding agencies that their investment will be managed responsibly. By aligning your financial requests directly with project needs and adhering to agency guidelines, you significantly strengthen your overall grant application.

Step 6: Gather Supporting Documentation and Letters of Support

A robust grant application extends beyond the core proposal and budget; it often requires a comprehensive suite of supporting documentation. These documents provide proof of your business’s legitimacy, financial health, and capacity to execute the proposed project. Just as crucial are letters of support, which can significantly bolster your application by demonstrating community backing and strategic partnerships.

The specific documents required will vary by grant program, but common requests include financial statements (e.g., profit and loss statements, balance sheets), resumes of key personnel, organizational charts, legal registration documents, and permits or licenses. Ensure all documents are current, accurate, and presented professionally. Many agencies require electronic submission, so prepare digital copies that meet specified file formats and size limits.

The Power of Letters of Support

Letters of support are external endorsements that validate your project’s importance and your organization’s credibility. These letters should come from reputable sources relevant to your project or business, such as:

- Community leaders: Mayors, city council members, or non-profit directors who can speak to your project’s local impact.

- Industry experts: Academics, researchers, or established professionals who can attest to the technical merit or innovation of your work.

- Potential partners or beneficiaries: Organizations or individuals who will collaborate on the project or directly benefit from its outcomes.

- Clients or customers: If relevant, testimonials demonstrating the need for your product/service.

Each letter should be specific to your project, highlighting how it addresses a particular need or achieves a valuable outcome. A generic letter of recommendation is far less impactful than one that directly references your grant proposal and the specific value your business brings. Request these letters well in advance of the deadline, providing your letter writers with all necessary information about your project and the grant opportunity.

Beyond external endorsements, consider including letters of commitment from any project partners. These letters formalize collaborations and demonstrate that all parties are dedicated to the project’s success. They can be particularly important for grants requiring inter-organizational cooperation or community engagement. Organize all supporting materials meticulously, ensuring they are correctly labeled and correspond to the requirements outlined in the NOFO.

Collecting supporting documentation and securing impactful letters of support are critical steps that provide external validation for your grant application. These elements collectively paint a comprehensive picture of your business’s capabilities, financial stability, and the broader community or industry backing for your proposed project, significantly enhancing its credibility.

Step 7: Review, Submit, and Follow Up

The final stage in the federal grant application process is perhaps the most critical for ensuring success: a thorough review, timely submission, and proactive follow-up. After investing significant time and effort into preparing your application, rushing this stage can undermine all previous work. A meticulous review process is essential to catch errors, ensure completeness, and confirm compliance with all requirements.

Before submission, perform a comprehensive review of your entire application package. Check for consistency across all documents, from the project narrative to the budget and supporting materials. Proofread for grammatical errors, typos, and formatting issues. Ensure all required forms are filled out correctly and completely. A small mistake can lead to rejection, so attention to detail here is paramount.

Submission Best Practices and Post-Submission Steps

- Adhere to deadlines: Submit your application well in advance of the official deadline. Technical issues with online portals are common, and late submissions are almost universally rejected.

- Follow submission instructions: Use the exact method specified by the agency (e.g., Grants.gov, email, postal mail). Confirm receipt if possible.

- Keep copies: Always retain a complete copy of your submitted application for your records.

Once submitted, the waiting game begins. Federal grant review processes can take several months. During this period, it’s generally advisable to avoid bombarding the agency with inquiries. However, if the grant guidelines permit, a polite follow-up email after a reasonable period (e.g., 6-8 weeks past the deadline) to confirm receipt and inquire about the review timeline can be acceptable. Be professional and patient.

If your application is successful, congratulations! Be prepared to engage in post-award activities, which typically include formalizing the grant agreement, attending orientation sessions, establishing reporting mechanisms, and initiating project activities. If your application is not selected for funding, view it as a learning opportunity. Many agencies provide feedback to unsuccessful applicants. Requesting this feedback can offer invaluable insights into areas for improvement for future applications. Don’t be discouraged; grant writing is often a process of refinement and persistence.

The final review and submission are the culmination of your efforts, demanding precision and adherence to strict protocols. Post-submission, patience and a strategic approach to follow-up are key, whether celebrating a success or learning from a setback. This entire process, from initial research to potential award, builds critical experience for future funding endeavors.

| Key Step | Brief Description |

|---|---|

| Research Grants | Identify federal opportunities fitting your business and project goals on Grants.gov and agency sites. |

| Ensure Eligibility | Carefully review NOFOs to confirm your business meets all criteria and understands requirements. |

| Register Systems | Complete SAM.gov registration (for UEI) and Grants.gov registration well in advance. |

| Craft Proposal | Develop a compelling project proposal, budget, and gather strong letters of support. |

Frequently Asked Questions About Federal Grants

Small businesses engaged in research and development, technology innovation, or those addressing specific national priorities like clean energy, healthcare, or community development often have a higher chance. Businesses with a clear, measurable impact and strong alignment with agency missions are also favored.

The entire process, from initial research to receiving funds, can take anywhere from six months to over a year. Registration processes alone can take several weeks. Grant review periods vary by agency and complexity, so patience and early preparation are crucial.

Federal grants do not need to be repaid, but they come with significant accountability. Recipients must adhere to strict reporting requirements, financial audits, and performance metrics. Funds must be used exactly as proposed and for the intended project goals.

While a track record helps, newer businesses can still succeed by focusing on a compelling project proposal, demonstrating strong team expertise, and securing robust letters of support. Emphasize innovation, feasibility, and potential impact. Some grants specifically target startups.

Resources like Small Business Development Centers (SBDCs), SCORE mentors, and university extension programs often offer free or low-cost assistance. Many also provide workshops and review services for grant proposals. Additionally, professional grant writers can be hired, though at a cost.

Conclusion

Securing U.S. federal grants for your small business in 2025 is an ambitious yet achievable goal that can provide transformative funding without incurring debt. The 7-step process outlined—from meticulous research and eligibility confirmation to rigorous registration, compelling proposal development, detailed budgeting, robust documentation, and careful submission—forms a structured pathway to success. While the journey demands diligence, strategic planning, and unwavering attention to detail, the potential rewards for innovation, growth, and community impact are substantial. By approaching each stage systematically and leveraging available resources, small businesses can effectively navigate the complexities of federal funding, unlocking opportunities that drive their vision forward and contribute significantly to the broader economic landscape.