Emerging Market Debt & US Stability: 4 Indicators for 2026

Latest developments on The Impact of Emerging Market Debt on US Economic Stability: 4 Key Indicators to Watch in 2026, with key facts, verified sources and what readers need to monitor next in Estados Unidos, presented clearly in Inglês (Estados Unidos) (en-US).

The Impact of Emerging Market Debt on US Economic Stability: 4 Key Indicators to Watch in 2026 is shaping today’s agenda with new details released by officials and industry sources. This update prioritizes what changed, why it matters and what to watch next, in a straightforward news format.

The intricate web of global finance means that economic shifts in one region can ripple across the world, significantly affecting seemingly distant economies. Emerging markets, characterized by rapid growth yet often volatile financial landscapes, represent a critical component of this global interconnectedness.

Their mounting debt, a topic of increasing concern, holds profound implications not just for the countries involved but also for major economic powers like the United States. Understanding these dynamics is crucial for investors, policymakers, and the general public.

As we advance towards 2026, the confluence of rising interest rates, inflationary pressures, and geopolitical uncertainties amplifies the potential for emerging market debt to destabilize global financial systems. The United States, with its deeply integrated economy, is particularly susceptible to these external shocks. Monitoring specific indicators will be paramount.

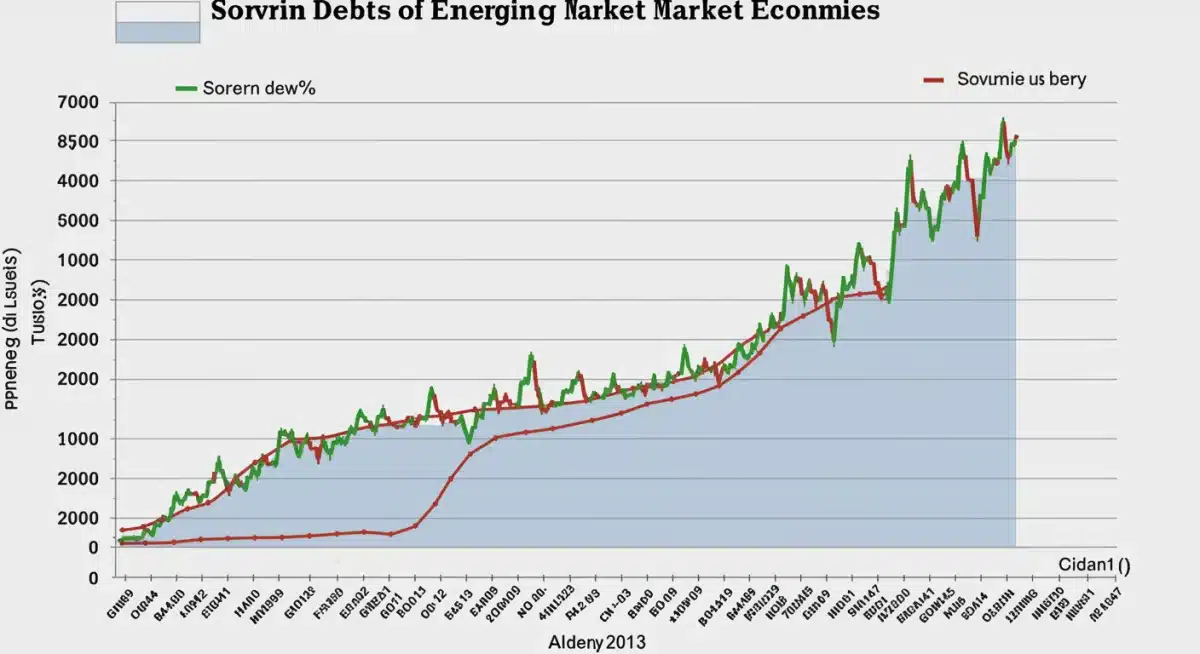

The Growing Landscape of Emerging Market Debt

Emerging market economies have increasingly relied on external borrowing to finance their development, infrastructure projects, and social programs. While this debt can fuel growth, it also introduces vulnerabilities, especially when global financial conditions tighten.

The sheer scale of this debt has expanded dramatically over the past decade, driven by periods of low global interest rates that encouraged borrowing. This expansion has led to record-high debt-to-GDP ratios in many of these nations, raising alarms about their repayment capacities.

The current global economic environment, marked by persistent inflation and aggressive monetary policy tightening by central banks like the Federal Reserve, places significant stress on these indebted nations. Higher borrowing costs make it more expensive to service existing debt and secure new financing, potentially leading to defaults and broader financial crises.

Historical Context and Recent Trends

Historically, emerging market debt crises have often been triggered by external shocks, such as sharp increases in global interest rates or significant currency depreciations. The 1980s Latin American debt crisis and the late 1990s Asian financial crisis serve as stark reminders of these vulnerabilities.

In recent years, the composition of emerging market debt has also evolved, with a greater proportion held by private creditors and a significant increase in local currency debt. This shift introduces new complexities in managing potential crises and assessing systemic risk.

The COVID-19 pandemic further exacerbated debt levels as governments spent heavily to mitigate economic fallout. Many countries are now grappling with the dual challenge of elevated debt and slower economic recovery, making the path to fiscal sustainability increasingly precarious.

Understanding the US Exposure to Emerging Market Debt

The United States economy, while robust, is not immune to financial instability originating in emerging markets. Direct and indirect channels link these economies, creating pathways for contagion if debt problems escalate.

US financial institutions hold significant exposure to emerging market debt through various instruments, including sovereign bonds, corporate loans, and equity investments. Any widespread defaults could trigger substantial losses for these institutions, impacting their balance sheets and lending capacities.

Beyond direct financial links, a crisis in emerging markets could disrupt global trade, reduce demand for US exports, and lead to capital flight towards safer assets, potentially strengthening the dollar. This strengthening dollar, while seemingly beneficial, can hurt US competitiveness and exacerbate trade imbalances.

Trade and Investment Channels

US companies have substantial investments in emerging markets, ranging from manufacturing facilities to service operations. A downturn in these economies can reduce profits, impair asset values, and lead to widespread layoffs, affecting US corporate earnings and employment.

Emerging markets are also key trading partners for the United States, importing a wide range of US goods and services. Economic contraction or currency devaluation in these countries would diminish their purchasing power, leading to a decline in US exports and potentially impacting specific industries and sectors.

Moreover, disruptions in global supply chains, often heavily reliant on emerging market production, could lead to inflationary pressures in the US and hinder economic growth. The interconnectedness of modern supply chains means that financial stress in one region can have far-reaching operational consequences.

Key Indicator 1: Sovereign Debt-to-GDP Ratios in Emerging Markets

The sovereign debt-to-GDP ratio is a fundamental measure of a country’s ability to service its debt. High and rising ratios often signal increasing fiscal stress and a higher probability of default, which can have immediate repercussions for global financial markets.

Many emerging market economies have seen their debt-to-GDP ratios climb to unprecedented levels, a trend accelerated by pandemic-related spending and slower economic growth. Monitoring these ratios provides an early warning signal of potential financial distress.

For the United States, a significant increase in defaults among major emerging economies could trigger a flight to safety, driving up demand for US Treasury bonds and potentially lowering long-term interest rates. However, it could also lead to a broader credit crunch if US banks and investors face substantial losses on their emerging market holdings.

Why This Matters for US Economic Stability

A widespread sovereign debt crisis in emerging markets could lead to a significant contraction in global trade, directly impacting US export-oriented industries. Reduced demand from these countries would translate into lower revenues and potential job losses in the US.

Furthermore, such a crisis could trigger a wave of capital flight from emerging markets, with investors seeking refuge in perceived safe-haven assets, including the US dollar. While a stronger dollar might seem beneficial, it makes US exports more expensive and imports cheaper, potentially widening the trade deficit and hurting domestic manufacturers.

The financial interconnectedness means that US mutual funds, pension funds, and other institutional investors hold substantial positions in emerging market sovereign debt. Defaults would directly hit these portfolios, reducing returns for millions of American savers and retirees.

Key Indicator 2: Emerging Market Currency Fluctuations

Currency stability is vital for emerging markets, as significant depreciations can make foreign-denominated debt more expensive to service and fuel domestic inflation. These fluctuations often reflect underlying economic weaknesses and investor confidence.

When emerging market currencies weaken sharply against the US dollar, countries with significant dollar-denominated debt find their repayment burdens increasing dramatically. This can quickly deplete foreign exchange reserves and push them closer to a balance of payments crisis.

For the US economy, extreme volatility in emerging market currencies can signal broader market instability, leading to increased risk aversion among investors. This can translate into tighter credit conditions globally and a reduction in cross-border investment flows, affecting US businesses operating internationally.

Impact on US Trade and Investment

A depreciating emerging market currency makes their exports cheaper and imports more expensive. This can make US goods less competitive in those markets, reducing US export volumes and impacting the profitability of American companies exporting to these regions.

Conversely, it makes US imports from emerging markets cheaper, potentially benefiting US consumers but also posing a challenge to domestic industries competing with these lower-priced goods. This dynamic can contribute to trade imbalances and affect specific sectors within the US economy.

US companies with operations or investments in emerging markets also face significant translation risks. Profits earned in local currencies will be worth less when converted back to US dollars, impacting overall corporate earnings and shareholder value. This highlights the complex nature of The Impact of Emerging Market Debt on US Economic Stability: 4 Key Indicators to Watch in 2026.

Key Indicator 3: Global Interest Rate Differentials and Capital Flows

The differential between interest rates in developed economies, particularly the US, and emerging markets significantly influences global capital flows. When US interest rates rise, capital tends to flow out of emerging markets in search of higher, safer returns.

This outflow of capital can put immense pressure on emerging market currencies, deplete their foreign exchange reserves, and make it harder for them to roll over existing debt or secure new financing. The Federal Reserve’s monetary policy decisions thus have a direct and powerful effect on emerging market stability.

For the US, sustained capital flight from emerging markets can have mixed effects. While it may strengthen the dollar and potentially lower domestic long-term rates initially, it also signals increased global financial stress, which can eventually feed back into the US economy through various channels, affecting The Impact of Emerging Market Debt on US Economic Stability: 4 Key Indicators to Watch in 2026.

The Federal Reserve’s Role and US Market Response

The Federal Reserve’s interest rate hikes, aimed at combating domestic inflation, inadvertently increase the borrowing costs for emerging markets with dollar-denominated debt. This creates a significant challenge for these economies, forcing them to choose between defending their currencies and managing their debt burdens.

If emerging markets face widespread defaults or crises due to tightening global liquidity, US financial markets will likely react with increased volatility and risk aversion. This could lead to a repricing of risk across various asset classes, impacting US equity and bond markets.

Moreover, a global financial contagion could prompt US investors to withdraw from riskier assets, including some domestic investments, leading to a broader economic slowdown. The interconnectedness underscores why the stability of emerging markets is a critical component of US economic health.

Key Indicator 4: Commodity Price Volatility

Many emerging market economies are heavily reliant on commodity exports for their revenues and foreign exchange earnings. Fluctuations in global commodity prices, therefore, have a direct and often profound impact on their economic stability and debt-servicing capacity.

A sharp decline in commodity prices can severely reduce export revenues for these countries, making it difficult to meet debt obligations and finance essential imports. This can quickly escalate into a balance of payments crisis and heighten the risk of sovereign default.

For the US, commodity price volatility can have a dual impact. While lower oil prices, for instance, might benefit US consumers, a collapse in commodity markets due to emerging market distress could signal a broader global economic slowdown, affecting US energy producers and manufacturing sectors. This is a crucial element when assessing The Impact of Emerging Market Debt on US Economic Stability: 4 Key Indicators to Watch in 2026.

Global Demand and Supply Shocks

The price of commodities like oil, metals, and agricultural products is influenced by global demand, which is heavily tied to the economic health of major economies, including emerging markets. A slowdown in these regions can depress commodity prices, creating a feedback loop of economic distress.

Supply-side shocks, such as geopolitical conflicts or natural disasters in key commodity-producing emerging markets, can also cause price spikes. While this might benefit some producers, it can hurt commodity-importing nations and lead to global inflationary pressures, affecting US consumers and businesses.

Monitoring commodity price trends provides valuable insight into the financial health of many emerging economies and, by extension, their potential to contribute to global financial instability that could impact the US economy. The ongoing shifts in these prices are a key element of The Impact of Emerging Market Debt on US Economic Stability: 4 Key Indicators to Watch in 2026.

Mitigation Strategies and Policy Responses

Addressing the risks posed by emerging market debt requires a multi-faceted approach involving both international cooperation and domestic policy adjustments. Proactive measures can help prevent crises and mitigate their impact on global economic stability.

International financial institutions like the IMF and World Bank play a crucial role in providing financial assistance and policy advice to distressed emerging economies. Their interventions can help stabilize markets and facilitate orderly debt restructuring, preventing broader contagion.

For the United States, maintaining robust financial regulatory frameworks and monitoring exposures of its financial institutions to emerging market risks is paramount. These measures help ensure that the US banking system remains resilient in the face of external shocks and limits The Impact of Emerging Market Debt on US Economic Stability: 4 Key Indicators to Watch in 2026 from becoming a full-blown crisis.

The Role of International Cooperation

Enhanced coordination among central banks and finance ministries of major economies is essential to manage global liquidity and address potential financial crises. Collaborative efforts can help stabilize markets and restore confidence when emerging markets face significant challenges.

Debt restructuring initiatives, sometimes involving multiple creditors and international organizations, are often necessary to provide indebted countries with breathing room. These initiatives aim to make debt burdens sustainable, allowing economies to recover and avoid prolonged financial distress.

Promoting transparency in debt reporting and fostering responsible lending and borrowing practices are also critical components of a long-term strategy. These measures help build a more resilient global financial system, one that can better absorb shocks from emerging market debt issues.

Looking Ahead to 2026: What to Expect

As we approach 2026, the landscape of emerging market debt will continue to be shaped by global economic trends, monetary policy decisions, and geopolitical developments. The indicators discussed will remain crucial for assessing potential risks and opportunities.

The trajectory of global inflation and the pace of interest rate adjustments by major central banks, particularly the Federal Reserve, will be paramount. These factors directly influence the borrowing costs and capital flows that impact emerging markets.

Moreover, geopolitical stability and commodity market dynamics will play a significant role. Disruptions in trade routes, conflicts, or unexpected shifts in supply and demand for key commodities could quickly alter the financial health of many emerging economies, underscoring the ongoing relevance of The Impact of Emerging Market Debt on US Economic Stability: 4 Key Indicators to Watch in 2026.

The US economy’s resilience will be tested by how effectively it can navigate these external pressures. While direct exposure to emerging market debt might be manageable for individual institutions, the cumulative effect of a widespread crisis could have profound indirect impacts through trade, investment, and market sentiment.

Policymakers in the US will need to maintain a vigilant watch on these indicators and be prepared to implement adaptive strategies. This includes close monitoring of financial institutions’ exposures, advocating for international cooperation, and ensuring domestic economic policies foster resilience against external shocks. The proactive management of The Impact of Emerging Market Debt on US Economic Stability: 4 Key Indicators to Watch in 2026 is essential for sustained growth.

| Key Indicator | Relevance to US Stability |

|---|---|

| Sovereign Debt Ratios | Signals default risk, impacts US financial institutions and global trade. |

| Currency Fluctuations | Affects US exports, corporate profits, and global capital flows. |

| Interest Rate Differentials | Drives capital flight from EMs, impacting US asset markets. |

| Commodity Price Volatility | Impacts EM revenues, global inflation, and US energy sector. |

Frequently Asked Questions About Emerging Market Debt and US Stability

The main concern is the ability of emerging market economies to service their rapidly growing debt, especially foreign-denominated debt, amidst rising global interest rates and potential currency depreciations. This could lead to defaults and broader financial instability.

US financial institutions hold significant exposure to emerging market sovereign and corporate debt. Defaults could lead to substantial losses, affecting their balance sheets, lending capacity, and potentially triggering a broader credit crunch within the US economy.

Sharp depreciations in emerging market currencies make foreign-denominated debt more expensive to repay and fuel domestic inflation. This volatility signals underlying economic stress and can impact US trade competitiveness and corporate earnings from overseas operations.

The Federal Reserve’s interest rate decisions significantly influence global capital flows. Higher US rates can draw capital from emerging markets, increasing their borrowing costs and potential for financial distress, thereby affecting The Impact of Emerging Market Debt on US Economic Stability: 4 Key Indicators to Watch in 2026.

Many emerging economies rely heavily on commodity exports. Price volatility directly impacts their revenues and ability to service debt. Declines can trigger crises, affecting global demand and supply chains, with consequences for US businesses and consumers.

What happens now

The intricate relationship between emerging market debt and US economic stability demands continuous vigilance. The four key indicators—sovereign debt-to-GDP ratios, currency fluctuations, global interest rate differentials, and commodity price volatility—provide essential lenses through which to monitor this critical dynamic. As 2026 approaches, market participants and policymakers must remain acutely aware of these interdependencies. Proactive risk management and strengthened international cooperation will be vital in navigating the evolving global financial landscape and mitigating potential adverse impacts on the US economy. The ongoing assessment of The Impact of Emerging Market Debt on US Economic Stability: 4 Key Indicators to Watch in 2026 will shape future policy and investment strategies.