Q1 2025: U.S. Government Tech Contracts – Deadline Approaching

Tech companies seeking federal business must act swiftly to capitalize on time-sensitive Q1 2025 U.S. government contract opportunities, as critical deadlines for these lucrative projects are rapidly approaching.

As Q1 2025 unfolds, a critical window of opportunity is closing for tech companies aiming to secure lucrative U.S. government contract opportunities for tech companies – deadline approaching. The federal landscape is ripe with demand for innovative technological solutions, but navigating the complex procurement process requires foresight and swift action. Missing these crucial deadlines could mean forfeiting significant business growth and impact.

Understanding the Federal Procurement Landscape in Q1 2025

The U.S. federal government represents the largest single purchaser of goods and services globally, and its appetite for cutting-edge technology continues to expand. Q1 2025 is particularly significant as agencies finalize budgets and initiate new projects, often with aggressive timelines. These contracts span a vast array of technological needs, from cybersecurity enhancements and artificial intelligence integration to cloud migration services and advanced data analytics platforms. For tech companies, understanding this intricate ecosystem is the first step toward securing a piece of this substantial market.

Navigating the federal procurement landscape requires more than just a great product or service; it demands a deep understanding of federal acquisition regulations (FAR), agency-specific requirements, and the various contracting vehicles available. Successful companies often invest in dedicated teams or external consultants to decipher these complexities, ensuring their proposals are compliant and competitive. The sheer volume of opportunities can be overwhelming, making strategic focus and meticulous preparation paramount.

Key Agencies and Their Tech Needs

Several federal agencies are particularly active in seeking technology solutions during Q1. Their needs often reflect national priorities and emerging threats.

- Department of Defense (DoD): A perennial leader in tech spending, the DoD is heavily investing in AI, machine learning, quantum computing, and advanced cybersecurity to maintain military superiority and protect critical infrastructure.

- Department of Homeland Security (DHS): Focuses on securing borders, critical infrastructure, and responding to cyber threats, requiring solutions in surveillance, data analytics, and secure communication systems.

- General Services Administration (GSA): Acts as the federal government’s procurement arm, facilitating a wide range of IT services and solutions for various agencies through schedules and blanket purchase agreements.

- Department of Veterans Affairs (VA): Modernizing its healthcare systems and patient data management, seeking solutions for telehealth, electronic health records, and data security.

Each of these agencies, along with many others, issues Requests for Proposals (RFPs) and other solicitations that detail their specific technology requirements. Monitoring these announcements through official channels like Sam.gov is crucial for identifying relevant opportunities. The window for response is often limited, reinforcing the time-sensitive nature of these Q1 2025 contracts.

In conclusion, the federal procurement landscape for tech in Q1 2025 is dynamic and demanding. Companies must not only possess innovative solutions but also demonstrate an acute awareness of governmental needs, regulatory frameworks, and the urgency associated with upcoming deadlines. Proactive engagement and strategic planning are indispensable for success in this competitive arena.

Identifying Time-Sensitive Q1 2025 Contract Opportunities

For tech companies, the ability to quickly identify and evaluate time-sensitive contract opportunities is a significant competitive advantage. Q1 2025 is characterized by a surge in new solicitations as agencies kick off their fiscal year initiatives. These opportunities often come with accelerated timelines, demanding a rapid response from prospective contractors. Effective identification involves leveraging various resources and adopting a proactive search strategy.

Beyond simply browsing Sam.gov, successful companies utilize advanced search filters, set up alerts, and engage with industry associations that often disseminate information about upcoming solicitations. Building relationships with agency personnel and prime contractors can also provide early insights into future needs, allowing for pre-emptive positioning. The key is to move beyond passive observation to active engagement and intelligence gathering.

Leveraging Sam.gov and Other Federal Portals

Sam.gov remains the primary portal for federal contract opportunities. However, its vastness can be daunting. Companies should focus on refining their search queries and utilizing advanced filters to pinpoint relevant solicitations. This includes filtering by North American Industry Classification System (NAICS) codes, Product Service Codes (PSCs), and specific agency names.

- NAICS Codes: Ensure your company’s NAICS codes are accurately registered and used in searches. These classify businesses by industry and are crucial for matching opportunities.

- Product Service Codes (PSCs): More granular than NAICS, PSCs describe the specific services or products being procured, allowing for highly targeted searches.

- Agency Filters: Directly search for opportunities released by agencies known to have significant tech needs, such as the DoD, DHS, or VA.

- Set-Aside Opportunities: Pay attention to contracts designated for small businesses, women-owned businesses, veteran-owned businesses, and other socio-economic categories.

Additionally, portals like GSA eBuy for GSA Schedule holders and specific agency acquisition sites can offer further insights. These platforms often host pre-solicitation notices, which provide an early look at upcoming requirements and allow companies more time to prepare.

The urgency surrounding Q1 2025 contracts cannot be overstated. Agencies are under pressure to obligate funds and initiate projects early in the fiscal year. This means that once an RFP is released, the response time can be significantly shorter than for solicitations later in the year. Companies must have their internal processes streamlined to react quickly, from proposal writing to legal review and executive approval.

In essence, identifying time-sensitive Q1 2025 opportunities requires a combination of robust search strategies, proactive engagement, and internal agility. The ability to quickly find, assess, and respond to these solicitations will be a defining factor in securing new federal business.

Crafting Winning Proposals Under Tight Deadlines

The competitive nature of federal contracting, especially for time-sensitive Q1 2025 opportunities, demands not just participation but excellence in proposal writing. A winning proposal is a meticulously crafted document that not only addresses all aspects of the Request for Proposal (RFP) but also clearly articulates a company’s unique value proposition. Under tight deadlines, this process becomes even more challenging, requiring efficiency, precision, and a deep understanding of governmental expectations.

Successful companies often employ a structured approach to proposal development, treating it as a project in itself. This includes assigning clear roles, establishing strict timelines, and conducting thorough reviews before submission. The goal is to produce a compliant, compelling, and error-free document that stands out among numerous competitors.

Essential Elements of a Strong Proposal

While each RFP is unique, certain elements are universally critical for a strong proposal. These components demonstrate a company’s capability, understanding, and commitment to the government’s objectives.

- Executive Summary: A concise, compelling overview that highlights the proposed solution, its benefits, and why your company is the best choice. It should be able to stand alone.

- Technical Approach: Detailed explanation of how your company will meet the technical requirements, demonstrating expertise and innovation.

- Management Plan: Outlines the project team, their qualifications, and the management structure to ensure successful project execution.

- Past Performance: Evidence of successful completion of similar projects, showcasing your company’s reliability and experience.

- Cost Proposal: A clear, defensible, and competitive cost breakdown that aligns with the proposed technical solution.

Beyond these core elements, a winning proposal must also address all specific instructions and evaluation criteria outlined in the RFP. Failure to follow instructions, no matter how minor, can lead to disqualification. This is particularly true for Q1 2025 contracts where agencies are often looking for quick, compliant solutions.

The pressure of tight deadlines necessitates a highly organized and collaborative approach. Companies should consider using proposal management software to streamline the process, facilitate collaboration among team members, and track progress. Developing a library of reusable content, such as company overviews, past performance descriptions, and standard methodologies, can also significantly reduce preparation time.

Furthermore, early engagement with the agency through pre-bid conferences or questions can provide valuable clarification, helping to refine the proposal’s focus and address potential ambiguities. This proactive communication demonstrates commitment and can help avoid common pitfalls that lead to non-compliant submissions.

Ultimately, crafting a winning proposal under tight deadlines is a testament to a company’s internal efficiency, strategic thinking, and dedication. It’s about delivering a clear, compelling narrative that not only meets but exceeds the government’s expectations, especially when the clock is ticking on Q1 2025 opportunities.

Navigating Compliance and Regulatory Hurdles

Securing a U.S. government contract entails more than just submitting a compelling proposal; it requires meticulous adherence to a complex web of compliance and regulatory requirements. For tech companies, this means navigating the Federal Acquisition Regulation (FAR), Defense Federal Acquisition Regulation Supplement (DFARS), and various agency-specific clauses. The stakes are particularly high for government tech contracts 2025, as increased scrutiny on federal spending and data security continues to shape policy. Non-compliance can lead to proposal rejection, contract termination, or even legal penalties, making it an area where no shortcuts can be taken.

Understanding and integrating these regulations into every stage of the contracting process, from initial proposal development to contract execution, is paramount. Companies must demonstrate not only technical proficiency but also a robust internal compliance framework. This often involves dedicated legal and compliance teams, or expert external counsel, to ensure every aspect of their operations aligns with federal mandates.

Key Compliance Areas for Tech Contractors

The regulatory landscape for tech contractors is constantly evolving, driven by new technologies and emerging threats. Several areas demand particular attention.

- Cybersecurity Requirements: Compliance with standards like NIST SP 800-171, CMMC (Cybersecurity Maturity Model Certification), and other agency-specific security protocols is often a prerequisite for handling federal data.

- Supply Chain Risk Management: Agencies are increasingly scrutinizing the supply chain for hardware and software to mitigate risks from foreign adversaries, requiring contractors to provide detailed information on their components and suppliers.

- Data Privacy and Protection: Adherence to federal laws and agency policies regarding the handling, storage, and transmission of sensitive government and citizen data.

- Small Business Subcontracting Plans: For larger contracts, prime contractors are often required to establish and report on plans for subcontracting with small businesses.

Beyond these, contractors must also be aware of ethical conduct standards, conflict of interest rules, and anti-corruption regulations. The government emphasizes transparency and integrity in all its dealings, expecting contractors to uphold the highest ethical standards.

The time-sensitive nature of Q1 2025 contracts means that companies must have their compliance ducks in a row well in advance of any solicitation. Attempting to address significant compliance gaps during a short proposal window is a recipe for disaster. This includes having necessary certifications, internal policies, and trained personnel in place. Investing in continuous training and staying updated on regulatory changes are essential for long-term success in the federal market.

In conclusion, navigating the compliance and regulatory hurdles for U.S. government tech contracts requires a proactive, informed, and diligent approach. It’s an ongoing commitment that underpins trustworthiness and ultimately determines a company’s ability to secure and retain federal business.

Strategic Partnerships and Subcontracting for Success

For many tech companies, particularly small and medium-sized enterprises (SMEs), venturing into the U.S. government contracting arena can seem daunting. The complexity, scale, and stringent requirements often necessitate collaboration. Strategic partnerships and subcontracting arrangements offer a powerful pathway to success, enabling companies to pool resources, combine expertise, and collectively address the comprehensive demands of federal solicitations. This approach is especially valuable for securing U.S. government contract opportunities for tech companies – deadline approaching in Q1 2025, where speed and comprehensive capabilities are critical.

Forming the right partnership can expand a company’s capabilities, past performance record, and access to necessary certifications. It can also mitigate risks by distributing responsibilities and leveraging existing relationships within the federal ecosystem. Whether as a prime contractor seeking subcontractors or as a subcontractor joining a larger team, understanding the dynamics of these collaborations is key to unlocking federal business.

Benefits of Strategic Alliances

Strategic alliances in government contracting offer a multitude of advantages, particularly when facing tight deadlines and complex requirements.

- Enhanced Capabilities: Partners can bring complementary technical skills, certifications, or specialized equipment to meet broad RFP requirements that a single company might not possess.

- Stronger Past Performance: Teaming allows companies to leverage the past performance records of all partners, improving the overall strength of a proposal, especially for new entrants to the federal market.

- Access to Set-Asides: A small business can partner with a larger firm as a subcontractor to meet small business utilization goals, or a prime can form a joint venture with a socio-economically disadvantaged business to pursue set-aside contracts.

- Risk Mitigation: Sharing the workload and financial burden can reduce the risk associated with large, complex federal projects.

- Market Access: Experienced prime contractors often have established relationships and a deeper understanding of agency needs, providing an entry point for smaller tech firms.

Identifying suitable partners requires careful research and due diligence. Companies should look for partners with a proven track record, complementary skills, and a shared commitment to ethical practices and project success. Networking events, industry conferences, and online federal contracting databases are excellent resources for finding potential collaborators.

For Q1 2025 opportunities, the ability to quickly form and formalize these partnerships is crucial. Pre-existing relationships or a clear strategy for identifying and engaging partners can significantly reduce the time spent on team formation, allowing more focus on proposal development. Subcontracting agreements must be clearly defined, outlining responsibilities, intellectual property rights, and payment terms to avoid future disputes.

In conclusion, strategic partnerships and subcontracting are not just options but often necessities for tech companies aiming to succeed in the U.S. government market. By leveraging the strengths of multiple entities, businesses can enhance their competitiveness, navigate complex requirements, and effectively pursue time-sensitive federal contracts.

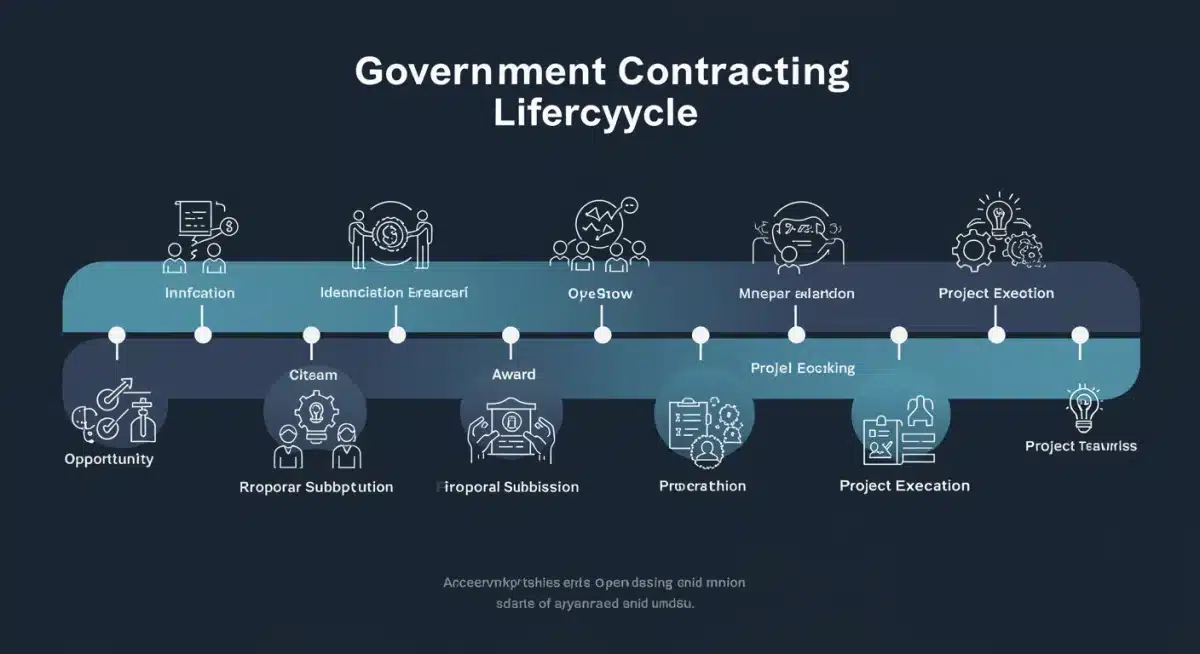

Post-Award Management and Relationship Building

Securing a U.S. government contract is a significant achievement, but it marks the beginning, not the end, of a critical journey. Effective post-award management is crucial for successful project execution, maintaining compliance, and, most importantly, building a strong reputation for future opportunities. For government tech contracts 2025 awarded in Q1, agencies will be keenly observing performance, as these early-year projects often set the tone for future engagements. A well-managed contract not only ensures project success but also lays the groundwork for long-term relationships and repeat business.

Post-award management encompasses a broad range of activities, from project planning and execution to financial tracking, reporting, and stakeholder communication. It requires a dedicated focus on meeting contractual obligations, managing scope changes, and proactively addressing any challenges that arise. The goal is to deliver exceptional value while adhering strictly to federal guidelines.

Key Aspects of Effective Post-Award Management

Successful contract execution and relationship building hinge on several critical practices.

- Project Planning and Execution: Develop a detailed project plan that aligns with the contract’s scope of work, timelines, and deliverables. Implement robust project management methodologies to ensure efficient execution.

- Financial Management and Reporting: Meticulously track all costs, expenditures, and billable hours. Ensure accurate and timely submission of invoices and financial reports, adhering to federal accounting standards.

- Performance Monitoring and Quality Assurance: Continuously monitor project performance against key metrics and quality standards. Implement quality assurance processes to ensure deliverables meet or exceed expectations.

- Communication and Stakeholder Management: Maintain open and transparent communication with the contracting officer, agency stakeholders, and any subcontractors. Provide regular updates and proactively address concerns.

- Compliance Oversight: Continuously monitor and ensure ongoing compliance with all federal acquisition regulations, cybersecurity standards, and any other specific contract clauses.

Building strong relationships with government clients extends beyond simply fulfilling contractual obligations. It involves understanding their evolving needs, anticipating challenges, and offering proactive solutions. This can lead to contract modifications, task order expansions, and positive references for future solicitations. Attending agency industry days and maintaining open lines of communication even outside of specific contract work can also foster these valuable relationships.

Furthermore, actively seeking feedback from the government client and incorporating lessons learned into future projects demonstrates a commitment to continuous improvement. For tech companies, this could mean showcasing how their solutions adapt to new agency requirements or integrate with emerging technologies. The federal government values reliable, innovative partners, and consistent high performance is the best way to earn that trust.

In summary, effective post-award management is as critical as winning the contract itself. It’s about demonstrating competence, reliability, and a commitment to partnership, which are essential for long-term success in the dynamic U.S. federal contracting market, especially for those securing Q1 2025 opportunities.

Future-Proofing Your Federal Contracting Strategy

The landscape of U.S. government contracting for tech companies is in constant flux, driven by rapid technological advancements, evolving national priorities, and dynamic geopolitical circumstances. To ensure sustained success beyond the immediate U.S. government contract opportunities for tech companies – deadline approaching in Q1 2025, companies must adopt a forward-thinking, adaptable strategy. Future-proofing your federal contracting strategy means anticipating changes, investing in relevant capabilities, and continuously refining your approach to remain competitive and relevant.

This proactive mindset involves more than just reacting to current solicitations; it requires an ongoing analysis of federal technology roadmaps, budget trends, and legislative developments. Companies that can predict future government needs and develop solutions ahead of the curve will be best positioned to capture subsequent waves of federal spending. This strategic foresight is a hallmark of successful, long-term federal contractors.

Adapting to Emerging Technologies and Policies

The federal government is a significant adopter of emerging technologies, and contractors must keep pace. Staying ahead requires continuous investment in research and development, employee training, and strategic partnerships.

- Artificial Intelligence (AI) and Machine Learning (ML): Agencies are increasingly integrating AI/ML into operations for data analysis, automation, and predictive capabilities. Companies with expertise in these areas will find growing demand.

- Cloud Computing and Edge Computing: The shift to cloud-first strategies continues, with an increasing focus on edge computing for real-time processing and enhanced security at remote locations.

- Cybersecurity Beyond Compliance: Moving beyond basic compliance to offer advanced, proactive cybersecurity solutions, including threat intelligence, zero-trust architectures, and incident response.

- Quantum Information Science (QIS): While still nascent, QIS is a long-term strategic area for defense and scientific agencies. Early engagement and R&D in this field could yield significant future opportunities.

Beyond technology, keeping abreast of policy changes, such as new small business initiatives, procurement reforms, or changes in data security regulations, is equally vital. Active participation in industry groups and direct engagement with policymakers can provide invaluable insights and influence. This ensures your company’s strategy remains aligned with federal objectives and regulatory frameworks.

Building a resilient federal contracting business also involves diversifying your portfolio across various agencies and contracting vehicles. Relying too heavily on a single agency or contract type can expose a company to significant risk if priorities shift or budgets are cut. A diversified approach creates stability and opens up new avenues for growth.

Finally, fostering a culture of continuous learning and adaptation within your organization is paramount. The federal market rewards agility and innovation. Companies that can quickly pivot, absorb new information, and integrate feedback will be the ones that thrive in the long run, securing not just Q1 2025 contracts but a sustained presence in the federal technology sphere.

| Key Point | Brief Description |

|---|---|

| Q1 2025 Urgency | Agencies finalize budgets and initiate projects with aggressive timelines, making early action critical for tech firms. |

| Identification Strategy | Leverage Sam.gov, NAICS/PSCs, and network to pinpoint time-sensitive tech opportunities quickly. |

| Proposal Excellence | Craft compliant, compelling proposals under tight deadlines, focusing on technical approach and past performance. |

| Compliance & Partnerships | Navigate complex regulations and form strategic alliances to enhance capabilities and mitigate risks. |

Frequently Asked Questions About Q1 2025 Government Tech Contracts

Q1 2025 marks the beginning of the federal fiscal year, when agencies often finalize budgets and initiate new projects. This period sees a surge in solicitations with shorter response windows, making it time-sensitive for tech companies to secure lucrative contracts.

Primary challenges include navigating complex federal acquisition regulations, crafting compliant and competitive proposals under tight deadlines, ensuring robust cybersecurity, and effectively identifying relevant opportunities amidst a vast federal landscape.

Companies should actively use Sam.gov with refined search filters (NAICS, PSCs), set up alerts, engage with industry associations, and network with agency personnel to gain early insights into upcoming solicitations and pre-solicitation notices.

Strategic partnerships enable tech companies to combine expertise, leverage stronger past performance records, access set-aside contracts, and mitigate risks. They are crucial for meeting complex RFP requirements and expanding market reach, especially for SMEs.

Effective post-award management ensures successful project execution, maintains compliance, and builds a strong reputation. Consistent high performance and proactive communication foster long-term relationships with government clients, paving the way for future business and repeat contracts.

Conclusion

The time-sensitive nature of Q1 2025 U.S. government contract opportunities for tech companies presents both significant challenges and immense potential. Success in this competitive arena hinges on a multi-faceted approach: meticulous opportunity identification, expert proposal crafting under pressure, unwavering regulatory compliance, and the strategic formation of partnerships. Beyond securing initial contracts, sustained growth in the federal market demands exceptional post-award management and a forward-looking strategy that anticipates technological shifts and policy changes. By embracing agility, diligence, and continuous adaptation, tech companies can not only meet the approaching deadlines but also establish a robust and enduring presence within the lucrative federal technology landscape.