U.S. Supply Chain Realignments: What to Expect Next 18 Months

The U.S. can expect significant shifts in global supply chain realignments over the next 18 months, characterized by increased regionalization, technological integration, and a persistent focus on resilience and risk mitigation.

The global economic landscape is in constant flux, and few areas reflect this dynamism more profoundly than supply chains. Over the next 18 months, the United States stands at the cusp of considerable transformation in its logistical and manufacturing networks, driven by evolving geopolitical realities, technological advancements, and a renewed emphasis on resilience. Understanding these U.S. supply chain realignment trends is crucial for businesses, policymakers, and consumers alike, as they will shape everything from product availability to economic stability. What can we truly anticipate as these intricate webs of production and distribution continue to reconfigure?

Geopolitical Tensions and Trade Policy Shifts

The intricate dance of global politics significantly influences how goods move across borders. In the coming 18 months, geopolitical tensions are expected to remain a primary driver of supply chain realignments, particularly impacting the United States. Trade policies, tariffs, and international relations will continue to shape sourcing decisions and manufacturing locations, pushing companies to rethink their global footprints.

The U.S. government’s stance on trade, particularly with major economic powers, will play a pivotal role. Policies aimed at reducing reliance on specific countries, bolstering domestic production, and securing critical resources are already in motion and will intensify. This often translates into complex decisions for multinational corporations navigating a fragmented regulatory environment.

The Impact of U.S.-China Relations

The relationship between the United States and China remains a central concern for global supply chains. Ongoing trade disputes, technological competition, and national security considerations are compelling companies to diversify their manufacturing and sourcing away from China. This strategy, often termed ‘China+1’ or ‘decoupling,’ seeks to reduce single-country dependence.

- Diversification of Sourcing: Businesses are actively exploring alternative manufacturing hubs in Southeast Asia, Latin America, and other regions to mitigate risks associated with U.S.-China tensions.

- Tariff Stability: The unpredictability of tariffs continues to influence long-term investment decisions, with companies seeking more stable and predictable trade environments.

- Technological Controls: Export controls on critical technologies, particularly semiconductors, are reshaping the tech supply chain, forcing companies to innovate domestically or seek partners in allied nations.

Furthermore, the U.S. is likely to continue leveraging trade agreements and alliances to strengthen its economic position and secure access to essential goods. This includes initiatives like the Indo-Pacific Economic Framework for Prosperity (IPEF), which aims to create more resilient and secure supply chains among partner countries. Such frameworks provide a structured approach for collaboration on trade, digital economy, clean energy, and anti-corruption efforts, fostering an environment for more reliable sourcing and production networks.

In essence, the next 18 months will see a sustained effort by the U.S. to de-risk its supply chains from geopolitical vulnerabilities. This involves a strategic re-evaluation of international partnerships and a deliberate move towards more resilient and politically aligned sourcing strategies, impacting everything from raw material acquisition to finished goods distribution.

The Reshoring and Nearshoring Imperative

The drive to bring manufacturing closer to home, whether through reshoring (returning production to the U.S.) or nearshoring (relocating to neighboring countries like Mexico or Canada), is gaining significant momentum. This trend is a direct response to the vulnerabilities exposed by recent global disruptions and a strategic move towards enhancing supply chain resilience. For the U.S., this imperative is about securing domestic capabilities and reducing lead times.

Companies are increasingly weighing the benefits of lower overseas labor costs against the rising risks of geopolitical instability, extended shipping times, and quality control issues. The balance is shifting, making domestic or regional production more attractive for certain industries and products. This isn’t a universal shift, but a targeted one, focusing on critical goods and strategic sectors.

Key Drivers for Domestic Production

Several factors are fueling the reshoring and nearshoring movement. Government incentives, technological advancements, and a desire for greater control over the production process are at the forefront. These drivers collectively create a compelling case for businesses to re-evaluate their global manufacturing strategies.

- Government Incentives: Legislation like the CHIPS and Science Act and the Inflation Reduction Act provides substantial subsidies and tax credits for domestic manufacturing in critical sectors such as semiconductors, electric vehicles, and renewable energy.

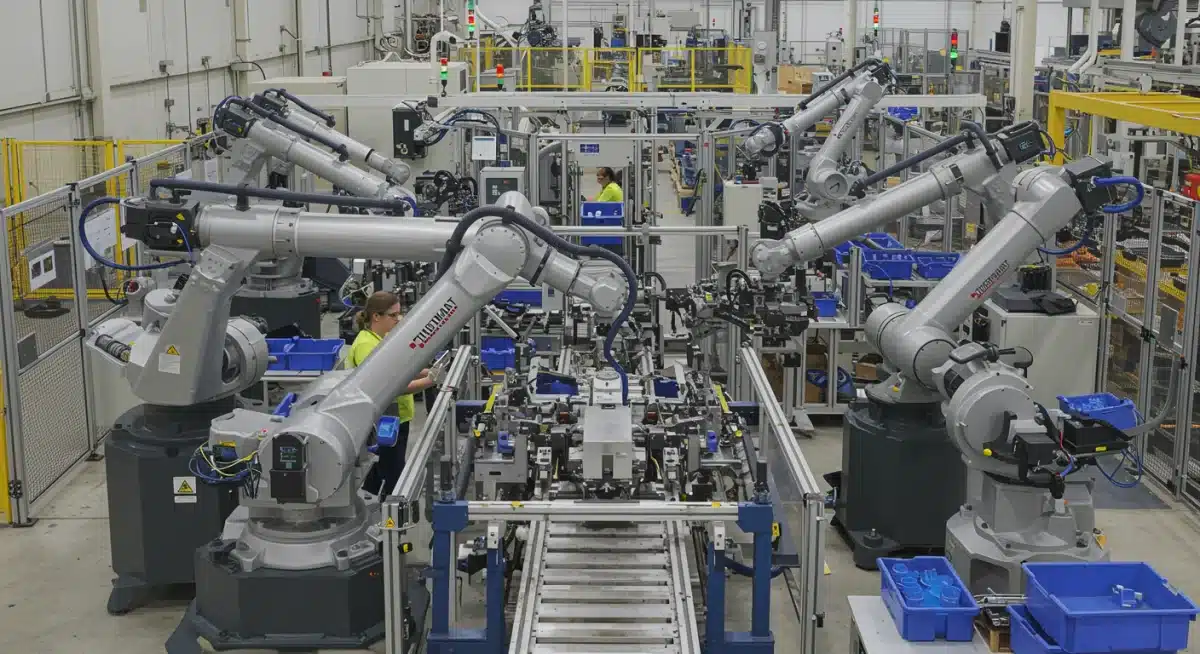

- Technological Advancements: Automation, advanced robotics, and artificial intelligence are making U.S. manufacturing more competitive by reducing reliance on manual labor and increasing efficiency.

- Reduced Lead Times and Inventory Costs: Shorter supply chains mean quicker response times to market demands and lower inventory holding costs, providing a significant operational advantage.

The U.S. is witnessing a resurgence in sectors deemed vital for national security and economic stability. This includes not only high-tech industries but also pharmaceuticals, medical supplies, and certain consumer goods. The aim is to create a more robust domestic industrial base capable of weathering future shocks and ensuring consistent availability of essential items.

Nearshoring to Mexico and Canada also presents an attractive alternative, leveraging existing trade agreements like the USMCA (United States-Mexico-Canada Agreement). These countries offer proximity, lower labor costs compared to the U.S., and established logistics infrastructure, making them ideal candidates for companies looking to maintain some cost advantages while reducing geopolitical exposure and improving supply chain agility.

Ultimately, the next 18 months will solidify reshoring and nearshoring as critical components of the U.S. strategy for a more resilient and secure supply chain. This shift will create new domestic job opportunities, foster innovation, and reshape the industrial landscape of North America.

Technological Integration and Digital Transformation

The future of global supply chains, particularly for the U.S., is inextricably linked to technological integration and digital transformation. Over the next 18 months, companies will continue to invest heavily in advanced technologies to enhance visibility, efficiency, and predictive capabilities across their networks. This technological leap is not merely an upgrade; it’s a fundamental reimagining of how supply chains operate.

The adoption of digital tools and platforms is becoming a non-negotiable requirement for maintaining competitiveness and resilience. From real-time tracking to AI-driven demand forecasting, technology offers solutions to many of the complex challenges inherent in modern supply chain management.

Leveraging Advanced Technologies

A suite of cutting-edge technologies is being deployed to revolutionize supply chain operations. These innovations promise to deliver unprecedented levels of transparency, automation, and data-driven decision-making, allowing businesses to react more swiftly and intelligently to disruptions.

- Artificial Intelligence (AI) and Machine Learning (ML): These technologies are being used for predictive analytics, demand forecasting, inventory optimization, and identifying potential disruptions before they occur.

- Blockchain: Blockchain offers enhanced traceability and transparency, particularly valuable in complex supply chains for verifying product authenticity and ethical sourcing.

- Internet of Things (IoT): IoT sensors provide real-time data on asset location, condition, and environmental factors, improving logistics and preventing spoilage or damage.

- Robotics and Automation: Beyond manufacturing, robotics are being deployed in warehouses and distribution centers to automate tasks like picking, packing, and sorting, increasing speed and accuracy.

The integration of these technologies allows for the creation of ‘digital twins’ of supply chains, enabling companies to simulate various scenarios and optimize their networks virtually before implementing changes in the physical world. This capability is crucial for proactive risk management and strategic planning in an unpredictable environment.

Furthermore, cloud-based platforms are facilitating seamless data sharing and collaboration among supply chain partners. This interoperability is essential for creating truly interconnected and responsive networks, breaking down traditional silos and fostering a more holistic approach to supply chain management. The emphasis will be on creating end-to-end visibility, allowing stakeholders to track products from raw materials to the final consumer.

In the next 18 months, the U.S. will see a significant acceleration in the digital maturity of its supply chains. Companies that fail to embrace these technological advancements risk falling behind, as efficiency, transparency, and agility become paramount for survival and growth.

Sustainability and Ethical Sourcing Priorities

Beyond efficiency and resilience, sustainability and ethical sourcing are emerging as paramount considerations for global supply chain realignments, particularly for the U.S. market. Over the next 18 months, there will be increasing pressure from consumers, regulators, and investors for companies to demonstrate a clear commitment to environmental stewardship and fair labor practices across their entire supply chain. This is no longer a niche concern but a core business imperative.

The shift towards sustainable practices is driven by a growing awareness of climate change, resource depletion, and social inequities. Companies are recognizing that neglecting these aspects can lead to significant reputational damage, regulatory penalties, and a loss of market share.

Green Supply Chain Initiatives

Businesses are adopting a variety of strategies to make their supply chains more environmentally friendly. These initiatives aim to reduce carbon footprints, minimize waste, and promote the responsible use of natural resources throughout the product lifecycle.

- Circular Economy Principles: Companies are moving towards models that emphasize recycling, reuse, and remanufacturing of products and materials, reducing reliance on virgin resources.

- Sustainable Logistics: This includes optimizing transportation routes, utilizing electric vehicles, and exploring alternative fuels to reduce emissions from freight movement.

- Renewable Energy Adoption: Investing in renewable energy sources for manufacturing facilities and warehouses, significantly lowering operational carbon emissions.

Moreover, the focus on ethical sourcing extends to ensuring fair wages, safe working conditions, and respect for human rights across all tiers of the supply chain. This requires rigorous due diligence, supplier audits, and transparent reporting to prevent issues like forced labor or child exploitation. Consumers are increasingly demanding to know the origins of their products and the conditions under which they were made, prompting brands to be more accountable.

Regulatory bodies in the U.S. and internationally are also stepping up their efforts to enforce sustainability and ethical standards. New legislation and reporting requirements will push companies to integrate these considerations into their core business strategies, rather than treating them as mere add-ons. This will necessitate greater collaboration with suppliers to ensure compliance and drive collective improvement.

In the coming 18 months, U.S. supply chains will undergo a critical transformation towards greater sustainability and ethical responsibility. This will involve significant investments in green technologies, robust ethical sourcing programs, and a fundamental shift in corporate culture to prioritize environmental and social impact alongside economic performance.

Labor Dynamics and Workforce Development

The effectiveness of any supply chain realignment in the U.S. relies heavily on the availability of a skilled and adaptable workforce. Over the next 18 months, labor dynamics will present both opportunities and challenges, requiring significant investment in workforce development and a re-evaluation of labor strategies. The demand for specific skills is evolving rapidly, driven by automation and the increasing complexity of modern logistics.

As manufacturing returns to the U.S. and technology integrates further into logistics, the types of jobs available are changing. There’s a growing need for workers proficient in robotics, data analytics, cybersecurity, and advanced manufacturing techniques. Addressing this skills gap will be crucial for the successful implementation of new supply chain models.

Addressing the Skills Gap

The U.S. faces a persistent challenge in matching its workforce capabilities with the demands of an evolving industrial landscape. Proactive measures are being taken to bridge this gap, involving collaboration between educational institutions, government, and private industry.

- Vocational Training Programs: Expansion of vocational and technical training programs focused on advanced manufacturing, logistics, and supply chain management to equip workers with relevant skills.

- Reskilling and Upskilling Initiatives: Companies are investing in programs to reskill existing employees for new roles created by automation and digital transformation, ensuring a smooth transition.

- Partnerships with Educational Institutions: Collaborations between businesses and community colleges or universities to develop curricula that meet industry needs and provide hands-on experience.

Furthermore, the attraction and retention of talent in the logistics and transportation sectors remain critical. Truck driver shortages, for instance, continue to pose a challenge to efficient goods movement. Efforts to improve working conditions, offer competitive wages, and leverage technology to enhance driver experience are underway to address these persistent issues.

The demographic shifts and changing expectations of the workforce also play a role. Younger generations are seeking more flexible work arrangements, opportunities for continuous learning, and roles that align with their values. Companies that can adapt their human resources strategies to meet these expectations will have a significant advantage in attracting and retaining top talent.

In the next 18 months, successful U.S. supply chain realignments will be underpinned by robust workforce development strategies. Investing in people, fostering a culture of continuous learning, and adapting to new labor market realities will be essential for building a resilient and competitive industrial base.

Infrastructure Investment and Logistics Optimization

A thriving and resilient U.S. supply chain hinges on robust infrastructure and optimized logistics networks. Over the next 18 months, significant investments and strategic planning will be directed towards upgrading transportation, warehousing, and digital infrastructure to support the evolving demands of global trade and domestic production. The goal is to ensure efficient, reliable, and cost-effective movement of goods across the nation.

The existing infrastructure, while extensive, often faces challenges such as congestion, aging facilities, and bottlenecks. As supply chains realign, these weaknesses become more pronounced, necessitating targeted investments and innovative solutions to enhance overall logistical capabilities.

Modernizing U.S. Logistics

Efforts to modernize U.S. logistics encompass a wide range of initiatives, from upgrading physical assets to implementing advanced management systems. These improvements are designed to reduce transit times, lower operational costs, and increase the capacity of the supply chain to handle greater volumes and complexity.

- Port Modernization: Investments in port infrastructure, including deeper channels, larger cranes, and automated container handling systems, to accommodate increasingly larger cargo ships and improve processing efficiency.

- Highway and Railway Upgrades: Repairing and expanding road and rail networks to alleviate congestion, improve intermodal connectivity, and facilitate faster freight movement across the country.

- Warehouse and Distribution Center Expansion: Development of new, technologically advanced warehouses and distribution centers, often strategically located near major transportation hubs, to support increased domestic manufacturing and e-commerce growth.

Furthermore, the integration of smart logistics solutions, powered by AI and IoT, will play a crucial role. These technologies enable real-time tracking, predictive maintenance for vehicles and equipment, and dynamic route optimization, leading to significant improvements in efficiency and responsiveness. The focus will be on creating a seamless flow of information and goods throughout the entire logistics ecosystem.

The private sector is also heavily involved, investing in automated material handling systems, drone technology for inventory management, and specialized cold chain logistics for sensitive goods. These private investments complement government initiatives, creating a comprehensive approach to modernizing the U.S. logistics landscape.

In the next 18 months, the U.S. will see concerted efforts to strengthen its logistics backbone. This will involve a combination of public and private sector investments aimed at building a more resilient, efficient, and technologically advanced infrastructure capable of supporting the realigned global supply chains.

Risk Mitigation and Resilience Building

The past few years have underscored the critical importance of risk mitigation and resilience building within global supply chains. For the U.S., the next 18 months will be characterized by a proactive and systemic approach to identifying, assessing, and mitigating potential disruptions. This goes beyond simply reacting to crises; it involves embedding resilience into the very design and operation of supply networks.

Companies and governments are now prioritizing strategies that can withstand unforeseen events, whether they are natural disasters, pandemics, cyberattacks, or geopolitical conflicts. The goal is to minimize the impact of disruptions, ensure business continuity, and maintain the flow of essential goods and services.

Strategies for Enhanced Resilience

Building a resilient supply chain requires a multi-faceted approach, combining strategic planning, technological tools, and collaborative efforts across the ecosystem. These strategies aim to create adaptable and robust networks capable of absorbing shocks and recovering quickly.

- Supply Chain Mapping and Transparency: Gaining full visibility into all tiers of the supply chain to identify single points of failure and potential vulnerabilities.

- Diversification of Suppliers and Geographies: Spreading production and sourcing across multiple regions and suppliers to reduce dependence on any single entity or location.

- Buffer Stock and Inventory Management: Maintaining strategic reserves of critical components and finished goods to cushion against unexpected shortages, balancing cost with security.

- Scenario Planning and Stress Testing: Regularly conducting simulations of various disruption scenarios to test the robustness of the supply chain and identify areas for improvement.

Furthermore, cybersecurity is becoming an increasingly vital component of supply chain resilience. As supply chains become more digitized and interconnected, they also become more vulnerable to cyber threats. Protecting sensitive data and operational systems from attacks is paramount to preventing disruptions and maintaining trust among partners.

Collaboration with government agencies, industry associations, and international partners is also crucial. Sharing information, best practices, and developing coordinated responses to potential threats can significantly enhance collective resilience. Public-private partnerships are particularly effective in addressing systemic risks that extend beyond the scope of individual companies.

In the next 18 months, the U.S. will see a heightened focus on embedding resilience as a core principle in supply chain management. This will involve continuous investment in risk intelligence, strategic diversification, and collaborative frameworks to build supply networks that are not only efficient but also robust against a wide array of potential shocks.

| Key Point | Brief Description |

|---|---|

| Geopolitical Shifts | U.S.-China tensions and trade policies are driving diversification and regionalization of supply chains, impacting sourcing and manufacturing locations. |

| Reshoring/Nearshoring | Increased domestic and regional manufacturing, supported by government incentives and automation, to reduce risks and enhance resilience. |

| Technological Integration | Widespread adoption of AI, IoT, and blockchain for enhanced visibility, efficiency, and predictive capabilities in logistics. |

| Sustainability Focus | Growing emphasis on green practices, ethical sourcing, and circular economy principles driven by consumer and regulatory pressure. |

Frequently Asked Questions About U.S. Supply Chain Realignments

The main drivers include geopolitical tensions, particularly with China, a push for greater resilience after recent disruptions, technological advancements like AI and automation, and increasing demands for sustainability and ethical sourcing from consumers and regulators.

Reshoring and nearshoring are expected to boost domestic manufacturing, create new jobs in critical sectors, reduce lead times, and enhance national security by securing supply for essential goods. This shift can also lead to more stable supply chains.

Technology is crucial for enhancing visibility, efficiency, and predictive capabilities. AI, IoT, and blockchain enable better demand forecasting, real-time tracking, and automated processes, making supply chains more agile and resistant to disruptions.

Sustainability is driving a shift towards circular economy principles, green logistics, and ethical sourcing practices. Companies are under pressure to reduce their carbon footprint, ensure fair labor, and transparently report on their environmental and social impact.

Key challenges include addressing the skills gap in advanced manufacturing, navigating evolving geopolitical landscapes, ensuring robust cybersecurity, and making significant infrastructure investments to support new logistical demands. Labor shortages remain a concern.

Conclusion

The next 18 months promise a period of dynamic and profound transformation for global supply chains, with the United States at the epicenter of many of these changes. From the strategic imperative of reshoring and nearshoring to the pervasive influence of geopolitical tensions, every aspect of product movement and manufacturing is being re-evaluated. Technological integration, driven by AI and automation, will continue to redefine efficiency and transparency, while an unwavering commitment to sustainability and ethical practices will become a non-negotiable benchmark for corporate responsibility. The U.S. will also need to strategically invest in its infrastructure and workforce development to fully capitalize on these realignments. Ultimately, the goal is to forge supply chains that are not only efficient and cost-effective but also inherently resilient, adaptable, and capable of navigating an increasingly complex and unpredictable global landscape, ensuring economic stability and consumer access to essential goods.