R&D Tax Credits: Fueling U.S. Business Innovation by 20% in 2025

U.S. government R&D tax credits are projected to significantly boost business innovation by 20% by 2025, providing essential financial incentives that drive research, development, and competitive advantage across various industries.

The landscape of American business is constantly evolving, driven by a relentless pursuit of new ideas and groundbreaking solutions. In this dynamic environment, R&D tax credits emerge as a critical catalyst, poised to fuel U.S. business innovation by an estimated 20% by 2025. These government incentives are not merely a fiscal adjustment; they are a strategic investment in the nation’s future, encouraging companies to push boundaries and redefine industries.

Understanding the R&D Tax Credit Landscape

The U.S. R&D tax credit, formally known as the Credit for Increasing Research Activities, has been a cornerstone of federal policy since its inception in 1981. It was designed to incentivize companies to conduct research and development domestically, fostering innovation that benefits the entire economy. This credit provides a dollar-for-dollar reduction in a company’s federal income tax liability, directly lowering the cost of innovation.

Initially temporary, the credit was made permanent in 2015 by the Protecting Americans from Tax Hikes (PATH) Act, solidifying its role as a long-term driver of economic growth. This permanence offers businesses much-needed predictability, allowing them to plan their research budgets and long-term innovation strategies with greater confidence. The stability provided by a permanent credit is crucial for projects that often require multi-year investments before yielding results.

Eligibility and Qualified Research Activities

Determining eligibility for R&D tax credits involves understanding what constitutes ‘qualified research activities’ (QRAs). The IRS provides specific guidelines that help businesses ascertain if their activities meet the criteria. These criteria are designed to be broad enough to encompass a wide range of innovative endeavors across various sectors.

- New or Improved Functionality: The research must aim to develop new or improve existing products, processes, software, inventions, techniques, formulas, or prototypes.

- Elimination of Uncertainty: The activities must involve a process of experimentation or evaluation of alternatives intended to eliminate uncertainty concerning the development or improvement of a product or process.

- Technological in Nature: The research must rely on the principles of physical or biological sciences, engineering, or computer science.

- Qualified Purpose: The research must be undertaken for a business purpose, not solely for aesthetic or stylistic reasons.

Understanding these four tests is fundamental for any company considering claiming the credit. Many businesses, especially small and medium-sized enterprises (SMEs), often underestimate the scope of activities that qualify, mistakenly believing only pure scientific research is eligible. In reality, routine engineering, software development, and process improvements can frequently qualify.

In essence, the R&D tax credit is a powerful tool for businesses across nearly all industries. By reducing the financial burden associated with innovation, it encourages companies to invest more in the research and development that underpins their future competitiveness and contributes to broader economic prosperity. Its enduring presence underscores the U.S. government’s commitment to nurturing a vibrant and innovative business ecosystem.

The Economic Impact: Driving Growth and Competitiveness

The economic ramifications of robust R&D tax credits are profound, extending far beyond individual companies to influence national economic growth and global competitiveness. By reducing the effective cost of innovation, these credits free up capital that businesses can reinvest into further research, hiring skilled personnel, and expanding operations. This cycle of investment creates a positive feedback loop that accelerates economic activity.

Studies consistently demonstrate a strong correlation between R&D investment and economic performance. Companies that actively engage in R&D tend to exhibit higher productivity, faster growth rates, and greater resilience during economic downturns. The tax credit acts as a direct subsidy for these growth-oriented activities, making them more financially viable.

Job Creation and Skilled Workforce Development

One of the most significant direct impacts of R&D tax credits is job creation. Research and development activities inherently require a highly skilled workforce, including scientists, engineers, technicians, and project managers. As companies increase their R&D spending, the demand for these specialized roles grows, leading to new employment opportunities.

- Increased Demand for STEM Professionals: A boost in R&D directly translates to a higher need for professionals in Science, Technology, Engineering, and Mathematics fields.

- Skilled Labor Retention: Companies are better able to retain their top talent by offering engaging and cutting-edge research projects, fostering a culture of innovation.

- Training and Upskilling: Enhanced R&D efforts often necessitate internal training programs, leading to the upskilling of existing employees and an overall more capable workforce.

Furthermore, the presence of a strong R&D sector attracts and retains intellectual capital within the U.S., preventing a ‘brain drain’ to other countries. This concentration of talent creates innovation hubs, like Silicon Valley or Research Triangle Park, which become magnets for further investment and entrepreneurial activity.

The R&D tax credit also plays a crucial role in maintaining America’s competitive edge on the global stage. In an increasingly interconnected and technologically driven world, nations that lead in innovation are those that thrive economically. By incentivizing domestic R&D, the U.S. government ensures that American companies remain at the forefront of technological advancement, developing the next generation of products and services that will shape future markets. This strategic support is vital for national security, economic prosperity, and global leadership. The credits essentially de-risk innovation, encouraging more companies to take the leap into transformative research.

Forecasting a 20% Boost in Innovation by 2025

The projection of a 20% surge in U.S. business innovation by 2025, largely attributed to R&D tax credits, is rooted in several converging factors. Firstly, the permanence of the credit provides a stable foundation for long-term strategic planning, encouraging companies to commit to multi-year research initiatives. This certainty allows for more ambitious projects that might otherwise be deemed too risky or costly without the tax incentive.

Secondly, increased awareness and better understanding of the credit’s applicability are expanding its reach. Many businesses, particularly SMEs, are realizing that their everyday problem-solving and process improvements qualify, not just groundbreaking scientific discoveries. This expanded participation across diverse industries will collectively drive innovation metrics upward.

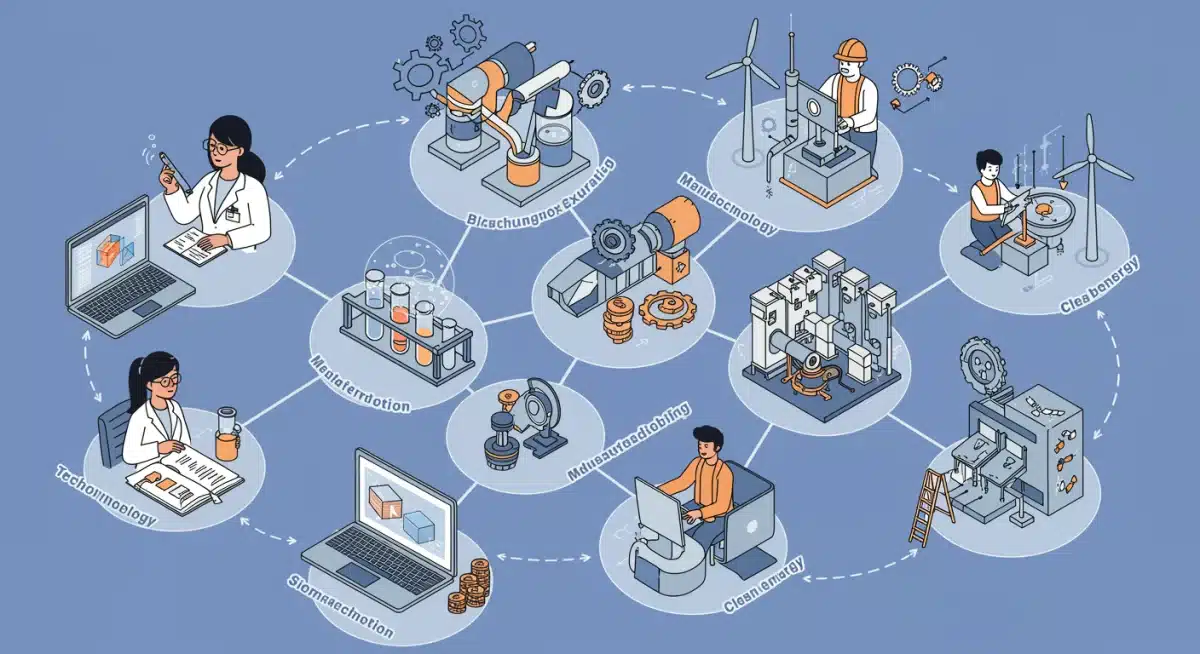

Key Sectors Poised for Significant Gains

While R&D tax credits benefit a broad spectrum of industries, certain sectors are particularly well-positioned to leverage these incentives for substantial innovation. These industries are often characterized by rapid technological change, high capital expenditure on research, and a constant need for new solutions to complex problems.

- Technology and Software Development: Ongoing advancements in AI, machine learning, cloud computing, and cybersecurity mean constant R&D is essential.

- Biotechnology and Pharmaceuticals: The race for new drugs, therapies, and medical devices requires immense investment in research, often spanning years or decades.

- Advanced Manufacturing: Innovations in automation, robotics, materials science, and additive manufacturing are critical for efficiency and competitiveness.

- Clean Energy: Development of renewable energy sources, storage solutions, and energy-efficient technologies is a high-priority area with significant R&D needs.

These sectors, often at the cutting edge of technological development, stand to gain immensely from the reduced financial burden of R&D. The credits enable them to accelerate product cycles, explore more speculative but potentially high-reward research avenues, and bring novel solutions to market faster. This acceleration of innovation in key industries has a ripple effect, fostering advancements in related sectors and creating new opportunities.

Moreover, the increased focus on domestic supply chains and manufacturing resiliency post-pandemic further amplifies the role of R&D tax credits. Companies are incentivized to innovate within the U.S., strengthening local economies and reducing reliance on foreign supply chains. This strategic alignment of tax policy with national economic priorities creates a powerful engine for innovation, making the 20% growth projection a realistic and achievable target for 2025.

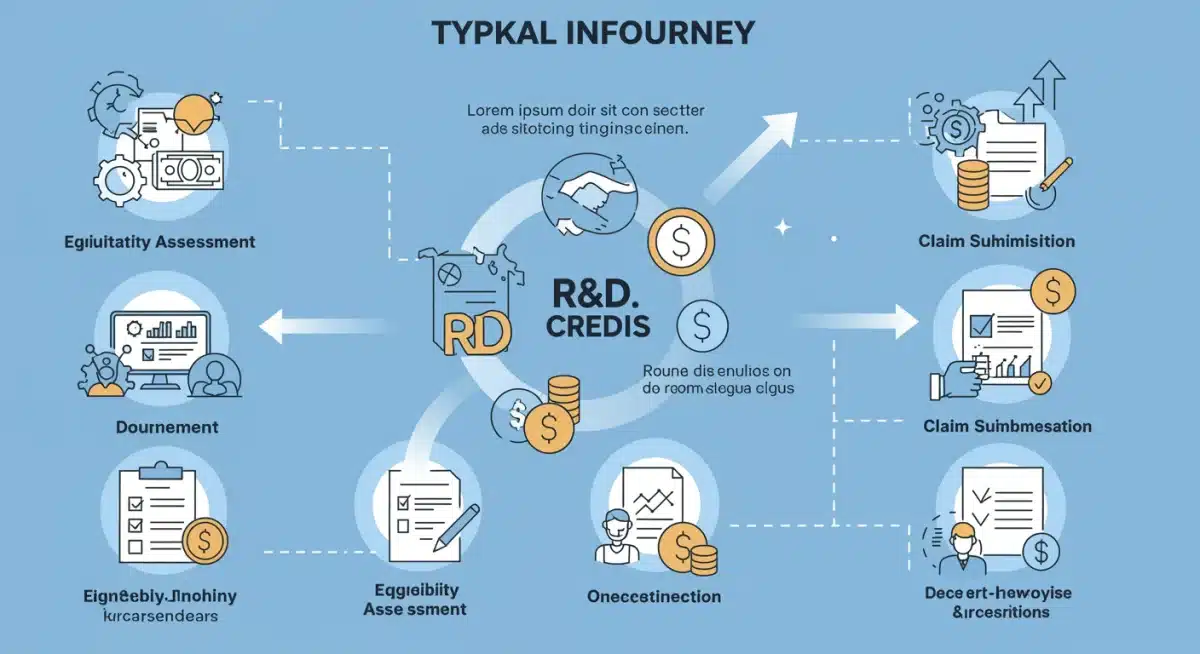

Navigating the Application Process: Tips for Businesses

While the benefits of R&D tax credits are clear, successfully claiming them requires careful attention to the application process and thorough documentation. Many businesses, particularly those new to the credit, can find the requirements daunting. However, with proper preparation and understanding, the process can be streamlined, allowing companies to fully capitalize on this valuable incentive.

The first step often involves a comprehensive review of a company’s activities to identify all potential qualified research expenditures (QREs). This includes not only direct research costs but also wages paid to employees performing qualified services, supply costs, and even certain contract research expenses. A detailed analysis is crucial to maximize the credit amount.

Documentation is Key: Proving Your Claim

The IRS places a strong emphasis on documentation to substantiate R&D tax credit claims. Businesses must be able to demonstrate that their activities meet the four-part test for qualified research. This often involves maintaining meticulous records that clearly outline the nature of the research, the uncertainties addressed, the process of experimentation, and the technological principles applied.

- Project Records: Keep detailed records of all R&D projects, including objectives, methodologies, and outcomes.

- Time Tracking: Implement robust systems for tracking employee time spent on qualified R&D activities.

- Financial Records: Maintain accurate records of all expenses related to R&D, such as wages, supplies, and contract research.

- Meeting Minutes and Lab Notebooks: Document decisions, challenges, and experimental results from R&D meetings and lab work.

Failing to maintain adequate documentation is one of the most common reasons for audit adjustments or disallowances. Proactive record-keeping from the outset of a project can save significant time and resources later. Many companies find it beneficial to integrate R&D documentation into their regular project management workflows.

Engaging with R&D tax credit specialists or consultants can also significantly ease the burden of the application process. These experts possess deep knowledge of tax law and IRS guidelines, helping businesses identify all eligible activities and compile comprehensive, audit-ready documentation. Their expertise can be invaluable in navigating complex regulations and ensuring compliance, ultimately maximizing the credit while minimizing risk. Investing in professional guidance can often yield a higher return on the R&D tax credit claim, making the entire process more efficient and effective for the business.

Success Stories: Real-World Impact of R&D Credits

The theoretical benefits of R&D tax credits are best understood through the lens of real-world success stories. Numerous companies, from small startups to large corporations, have leveraged these incentives to achieve significant milestones in innovation, expand their operations, and create new jobs. These case studies underscore the tangible impact of government support for research and development.

Consider a small manufacturing firm that developed a new, energy-efficient production process. Without the R&D tax credit, the upfront investment in research and engineering might have been prohibitive. However, the credit reduced their tax liability, making the project financially feasible. This innovation not only improved their profitability but also reduced their environmental footprint and allowed them to gain a competitive edge in their market.

Diverse Industries, Shared Benefits

The impact of R&D credits is not confined to a single industry. Its broad applicability means that companies across diverse sectors can find ways to innovate and benefit. The examples below highlight this versatility.

- Biotech Startup: A nascent biotechnology company utilized the R&D credit to fund critical early-stage research for a novel disease diagnostic. The credit allowed them to extend their runway, attract further investment, and ultimately bring a life-saving product closer to market.

- Software Developer: A software company invested in developing a complex AI-driven analytics platform. The R&D tax credit helped offset the substantial development costs, enabling them to hire more specialized engineers and accelerate the platform’s launch, securing a leading position in a rapidly growing niche.

- Agricultural Technology: An AgTech firm developed precision farming equipment that optimizes irrigation and fertilizer use. The R&D credit supported the extensive engineering and field testing required, leading to a product that helps farmers reduce costs and improve sustainability.

- Renewable Energy Innovator: A company specializing in solar panel efficiency improvements used the credit to invest in advanced material science research, resulting in panels with higher energy conversion rates and lower manufacturing costs.

These examples illustrate a common theme: R&D tax credits empower businesses to take calculated risks on innovative projects that might otherwise be shelved due to financial constraints. By mitigating some of the financial burden, the government effectively co-invests with companies in the future of American innovation. These success stories serve as powerful testimonials to the credit’s effectiveness, inspiring other businesses to explore how they too can leverage this vital incentive to drive their own research and development efforts, contributing to the broader economic fabric of the nation.

Potential Challenges and Mitigation Strategies

While R&D tax credits offer substantial benefits, businesses can encounter several challenges in claiming them. Navigating complex tax codes, ensuring proper documentation, and understanding eligibility criteria can be daunting, especially for companies without dedicated tax or finance teams. However, with proactive planning and strategic approaches, these challenges can be effectively mitigated, ensuring companies maximize their credit utilization.

One primary challenge is the perception that only ‘white-coat’ research qualifies. Many businesses mistakenly believe their routine engineering, software development, or process improvement activities are not eligible. This misunderstanding leads to many companies leaving significant tax savings on the table. Educating internal teams and seeking expert advice can help overcome this misconception.

Overcoming Documentation Hurdles and Audit Risks

Another significant hurdle is the rigorous documentation required by the IRS. Without meticulous record-keeping, claims can be disallowed during an audit. This necessitates a proactive approach to capturing data related to R&D activities from the project’s inception.

- Implement Robust Tracking Systems: Use project management software or dedicated R&D tracking tools to log hours, expenses, and project progress.

- Educate Project Managers: Train project leaders on the types of information needed for R&D claims to ensure data is captured consistently.

- Regular Internal Reviews: Conduct periodic internal audits of R&D documentation to identify and rectify any gaps before submitting a claim.

- Seek Expert Assistance: Partner with R&D tax credit specialists who can help structure documentation and prepare for potential audits.

The risk of an IRS audit is a legitimate concern for many businesses. While no claim is entirely immune from audit, well-documented and thoroughly prepared claims significantly reduce this risk and improve the chances of a favorable outcome. Proactive engagement with tax professionals who specialize in R&D credits can provide an invaluable layer of protection and ensure that all aspects of the claim are compliant with current tax law.

Furthermore, changes in tax legislation can sometimes create uncertainty. Staying abreast of these changes requires continuous monitoring of tax policy developments. Subscribing to tax news updates, attending webinars, and consulting with tax advisors are effective strategies to remain informed. By addressing these potential challenges head-on with robust internal processes and expert guidance, businesses can confidently leverage R&D tax credits, turning potential obstacles into opportunities for sustained innovation and financial benefit.

The Future of Innovation: Beyond 2025

Looking beyond 2025, the trajectory of U.S. innovation, significantly propelled by R&D tax credits, appears set for continued growth and evolution. The foundation laid by current policies and the projected 20% boost in business innovation will likely create a self-sustaining ecosystem where innovation begets further innovation. As companies become more adept at leveraging these credits, the overall culture of research and development within American industries will strengthen.

Future policy discussions may focus on refining the R&D credit to address emerging technologies and economic shifts. For instance, there could be increased emphasis on credits for sustainable technologies, AI development, or even space exploration, aligning tax incentives with national strategic priorities. The adaptability of the credit will be crucial in maintaining its relevance and effectiveness in a rapidly changing global landscape.

Evolving Policy and Broader Economic Integration

The long-term success of R&D tax credits will also depend on their integration with broader economic and industrial policies. This includes fostering a robust educational pipeline for STEM talent, promoting entrepreneurship, and ensuring access to capital for innovative ventures. The credits are just one piece of a larger puzzle aimed at cultivating a dynamic and competitive economy.

- Targeted Incentives: Future iterations might include more targeted credits for specific types of research that address critical national challenges, such as climate change or public health crises.

- Streamlined Application: Efforts to simplify the application process, especially for small businesses, could further increase participation and reduce administrative burdens.

- International Competitiveness: Continued evaluation of how U.S. R&D incentives compare to those offered by other leading innovative nations will be essential to maintain global competitiveness.

The synergy between government incentives, private sector ingenuity, and academic research institutions will define the next era of innovation. R&D tax credits act as a crucial bridge, connecting financial policy with scientific and technological advancement. By continuously evaluating and adapting these incentives, the U.S. government can ensure that American businesses remain at the forefront of global innovation, driving economic prosperity and addressing the challenges of tomorrow.

Ultimately, the impact of R&D tax credits extends beyond mere financial savings; they represent a strategic commitment to fostering a culture of continuous improvement and groundbreaking discovery. As we move further into the 21st century, the foresight embedded in these policies will continue to pay dividends, ensuring that the U.S. remains a global leader in innovation and economic dynamism. The momentum gained by 2025 will serve as a powerful springboard for even greater achievements in the decades to come.

| Key Aspect | Brief Description |

|---|---|

| Credit Purpose | Incentivizes U.S. companies to conduct research and development, reducing tax liability. |

| Innovation Forecast | Projected to boost U.S. business innovation by 20% by 2025 due to sustained incentives. |

| Eligibility | Activities must involve new/improved functionality, eliminate uncertainty, be technological, and have a qualified business purpose. |

| Key Impact | Drives job creation, fosters a skilled workforce, and enhances global competitiveness for U.S. businesses. |

Frequently Asked Questions About R&D Tax Credits

R&D tax credits are federal tax incentives designed to encourage U.S. companies to conduct research and development activities. They provide a dollar-for-dollar reduction in a company’s federal income tax liability, directly lowering the cost of innovation and fostering economic growth across various sectors.

Qualified activities must aim to develop new or improve existing products, processes, or software. They must involve a process of experimentation to eliminate uncertainty, be technological in nature, and serve a qualified business purpose. This can include engineering, software development, and process improvements.

The permanence of the credit and increased awareness allow businesses to invest more confidently in long-term research. By reducing the financial burden of R&D, companies can accelerate product development, explore riskier ventures, and hire more skilled personnel, collectively driving a significant increase in innovation.

While broad, industries like technology and software development, biotechnology and pharmaceuticals, advanced manufacturing, and clean energy are particularly poised for significant gains. These sectors inherently require substantial R&D investment to remain competitive and drive progress.

Challenges include understanding complex eligibility criteria, ensuring meticulous documentation to substantiate claims, and mitigating audit risks. Many businesses overcome these by implementing robust tracking systems, educating internal teams, and engaging specialized R&D tax credit consultants.

Conclusion

The U.S. government’s R&D tax credits stand as a powerful testament to the nation’s commitment to fostering a dynamic and innovative economy. As projected, these incentives are poised to dramatically enhance business innovation by 20% by 2025, driving growth, creating high-value jobs, and solidifying America’s competitive edge on the global stage. By understanding the eligibility requirements, meticulously documenting qualified activities, and leveraging expert guidance, businesses of all sizes can effectively harness these credits to fuel their research and development efforts. The long-term impact extends beyond immediate financial benefits, cultivating a sustainable ecosystem of discovery and progress that will continue to shape the future of industries and the nation’s economic landscape for years to come.