Investment Focus: Top 3 U.S. Sustainable Business Trends for Investor Returns in 2025

Investors seeking robust returns in the U.S. market by 2025 should focus on sustainable business trends, particularly in renewable energy advancements, circular economy initiatives, and sustainable agriculture, as these sectors demonstrate strong growth potential and alignment with evolving consumer and regulatory demands.

In a rapidly evolving global landscape, the intersection of environmental responsibility and financial viability has become a cornerstone of modern investment strategy. For those looking to capitalize on future growth, an investment focus: Top 3 U.S. sustainable business trends to watch for investor returns in 2025 offers a roadmap to lucrative opportunities. This article delves into the burgeoning sectors where sustainability isn’t just a buzzword, but a powerful driver of innovation, market leadership, and significant financial upside.

The Rise of Sustainable Investing in the U.S. Market

The U.S. investment landscape is witnessing a profound shift towards sustainability, driven by a confluence of factors including increasing consumer awareness, stricter regulatory frameworks, and a growing understanding of long-term climate risks. This paradigm shift means that companies integrating environmental, social, and governance (ESG) principles are often outperforming their less sustainable counterparts, attracting capital and fostering innovation.

Understanding this evolution is crucial for investors aiming for robust returns. The demand for sustainable products and services is not merely a niche market anymore; it’s becoming mainstream. From institutional funds to individual investors, there’s a clear preference for businesses that demonstrate a commitment to both profit and purpose. This trend is reshaping industries and creating new avenues for value creation.

Driving Forces Behind Sustainable Investment Growth

Several key factors are accelerating the adoption of sustainable investment practices across the United States. These forces are creating a fertile ground for businesses that prioritize environmental and social impact alongside financial performance.

- Consumer Demand: A significant portion of consumers, especially younger generations, are actively seeking out brands and products that align with their values, pushing companies to adopt more sustainable practices.

- Regulatory Pressure: Government policies and international agreements are increasingly mandating environmental protection and social responsibility, creating a more favorable operating environment for compliant businesses.

- Technological Advancements: Innovations in areas like renewable energy, waste management, and sustainable agriculture are making eco-friendly solutions more efficient and cost-effective.

- Risk Mitigation: Companies with strong ESG performance tend to exhibit lower volatility and better resilience during economic downturns, appealing to risk-averse investors.

The convergence of these drivers means that sustainable investing is no longer just an ethical choice but a strategic imperative. Businesses that fail to adapt risk falling behind, while those that embrace sustainability are positioned for long-term success and attractive investor returns.

In conclusion, the U.S. market’s embrace of sustainable investing is a powerful indicator of future economic direction. Investors who proactively identify and engage with businesses at the forefront of these trends are likely to reap significant rewards as the economy continues its green transformation.

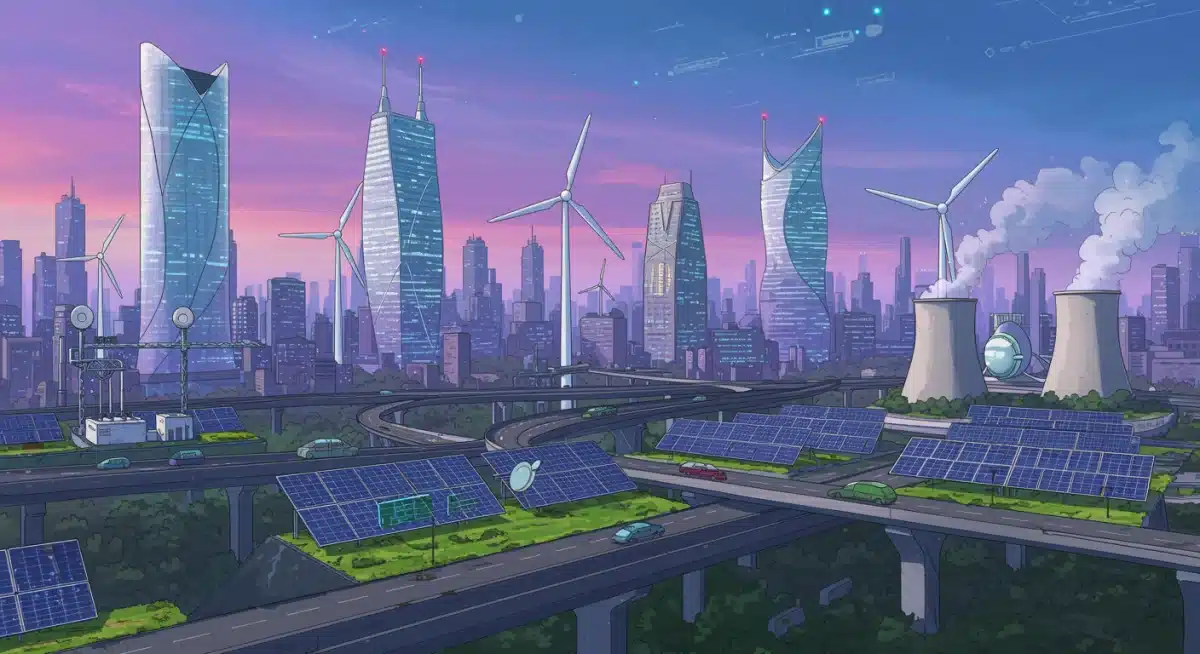

Trend 1: Renewable Energy Advancements and Storage Solutions

The renewable energy sector continues to be a powerhouse for sustainable investment, and its trajectory for 2025 points to accelerated growth, particularly in advanced energy generation and storage. The U.S. is heavily investing in technologies that not only produce clean energy but also store it efficiently, addressing one of the biggest challenges of intermittent sources like solar and wind.

This trend is characterized by rapid technological innovation, declining costs, and supportive government policies aimed at decarbonizing the grid. From utility-scale projects to distributed energy resources, the opportunities are vast and varied, promising significant returns for early and strategic investors.

Breakthroughs in Solar and Wind Technologies

Solar and wind power remain at the forefront of renewable energy, with continuous advancements making them more efficient and accessible. These improvements are crucial for scaling up clean energy production and integrating it seamlessly into existing infrastructure.

- Perovskite Solar Cells: Emerging as a highly efficient and cost-effective alternative to traditional silicon, perovskite technology is set to revolutionize solar energy with its potential for flexible and transparent applications.

- Offshore Wind Expansion: The U.S. is poised for a massive expansion in offshore wind capacity, leveraging stronger and more consistent winds to generate substantial amounts of clean electricity.

- Smart Grid Integration: Advanced analytics and AI are optimizing the integration of diverse renewable sources into smart grids, ensuring stable and reliable power delivery.

The Critical Role of Energy Storage

While renewable energy generation is vital, effective energy storage solutions are equally critical for grid stability and reliability. Innovations in this area are transforming how energy is managed and consumed, creating new investment horizons.

Battery technology, especially lithium-ion and emerging solid-state batteries, is central to this trend. Beyond batteries, other storage methods like pumped-hydro, compressed air, and thermal storage are also gaining traction, offering diverse solutions for different scales and applications. Companies developing and deploying these advanced storage systems are positioned for substantial growth.

The convergence of advanced renewable generation and sophisticated storage solutions represents a powerful investment opportunity. As the U.S. pushes towards a cleaner energy future, businesses leading in these areas will not only contribute to environmental sustainability but also deliver impressive financial returns for investors in 2025 and beyond.

Trend 2: Circular Economy and Waste-to-Value Innovations

The concept of a linear economy—take, make, dispose—is rapidly being replaced by the principles of a circular economy, which emphasizes reducing waste, reusing materials, and recycling resources. This shift is not just an environmental imperative but a significant economic opportunity, particularly in the U.S. market.

By 2025, businesses focused on circular economy principles, especially those transforming waste into valuable products, are expected to see substantial growth. This trend encompasses everything from advanced recycling technologies to innovative product design that prioritizes durability and recyclability from the outset.

Redefining Waste as a Resource

One of the core tenets of the circular economy is the re-evaluation of waste, seeing it not as an end-product but as a valuable resource. Companies that can effectively convert waste streams into new products or energy are at the forefront of this revolution.

- Advanced Recycling Technologies: Chemical recycling, which breaks down plastics to their molecular level for reuse, and textile-to-textile recycling are gaining traction, offering solutions for hard-to-recycle materials.

- Bio-based Materials: The development of biodegradable plastics and materials derived from renewable biological resources is reducing reliance on fossil fuels and minimizing environmental impact.

- Industrial Symbiosis: Companies are collaborating to utilize each other’s waste products as raw materials, creating closed-loop systems that minimize overall resource consumption and waste generation.

Innovations in Product Life Cycle Management

Beyond waste conversion, the circular economy also focuses on extending the life of products and components through better design, repair, and refurbishment. This approach reduces the need for new raw materials and energy-intensive manufacturing processes.

Businesses specializing in product-as-a-service models, where consumers pay for the use of a product rather than its ownership, are thriving. This encourages manufacturers to design for longevity and easy repair. Similarly, companies offering repair and refurbishment services for electronics, appliances, and industrial equipment are seeing increased demand. The growth in reverse logistics, facilitating the return and reprocessing of used products, also presents considerable investment potential.

The transition to a circular economy is a complex but highly rewarding endeavor. U.S. companies that innovate in waste-to-value solutions and product life cycle management are not only contributing to a more sustainable planet but are also poised to capture significant market share and deliver compelling returns for investors by 2025.

Trend 3: Sustainable Agriculture and Food Systems

The global demand for food continues to rise, placing immense pressure on agricultural systems. In the U.S., a growing emphasis on sustainable agriculture and resilient food systems is creating a fertile ground for innovation and investment. This trend is driven by concerns over environmental degradation, food security, and consumer preferences for ethically produced and healthier food.

By 2025, businesses that are transforming how food is grown, processed, and distributed—focusing on efficiency, reduced environmental impact, and enhanced nutritional value—are set to attract substantial capital and deliver strong investor returns. This includes everything from precision agriculture technologies to alternative protein sources.

Precision Agriculture and Resource Efficiency

Leveraging technology to optimize farming practices, precision agriculture is revolutionizing the industry by minimizing resource use and maximizing yields. This approach is critical for sustainable food production.

- IoT and AI in Farming: Internet of Things (IoT) sensors and artificial intelligence (AI) are being used to monitor soil health, crop growth, and livestock conditions, allowing for precise application of water, fertilizers, and pesticides.

- Vertical and Urban Farming: These innovative farming methods reduce land usage, water consumption, and transportation costs by growing crops in controlled indoor environments, often in urban areas.

- Water Management Solutions: Technologies that improve irrigation efficiency, capture rainwater, and recycle agricultural water are becoming increasingly vital as water scarcity intensifies.

Alternative Proteins and Sustainable Food Production

The search for more sustainable and ethical protein sources is driving significant investment into alternative protein markets. This sector is poised for explosive growth as consumer preferences shift away from traditional animal agriculture.

Plant-based meats, dairy alternatives, and cultivated meat (lab-grown meat) are gaining mainstream acceptance and attracting substantial venture capital. Companies developing these products are not only addressing environmental concerns but also catering to a growing market segment focused on health and animal welfare. Furthermore, innovations in sustainable aquaculture and insect-based proteins are also presenting exciting new opportunities within the broader food system transformation.

Investing in sustainable agriculture and food systems offers a dual benefit: contributing to a healthier planet and feeding a growing population, all while generating attractive financial returns. As the U.S. food industry continues its transformation, businesses at the forefront of these innovations will be key drivers of investor success in 2025.

Navigating Investment Opportunities in Sustainable Markets

Identifying and capitalizing on sustainable business trends requires a nuanced approach that goes beyond traditional financial metrics. Investors must consider a company’s ESG performance, its long-term strategic vision, and its ability to adapt to evolving market demands. This involves diligent research and a forward-looking perspective to uncover truly impactful and profitable ventures.

The sustainable market is dynamic, with new technologies and business models emerging constantly. Staying informed about regulatory changes, consumer preferences, and technological breakthroughs is paramount for making informed investment decisions. This proactive stance allows investors to position themselves ahead of the curve, maximizing potential returns.

Key Considerations for Sustainable Investment

When evaluating sustainable investment opportunities, several factors should guide your decision-making process. These considerations help in distinguishing between genuine sustainable growth and mere greenwashing.

- Authenticity of ESG Claims: Scrutinize companies’ ESG reports and practices to ensure their sustainability commitments are genuine and measurable, not just marketing ploys.

- Innovation and Scalability: Prioritize companies that are not only innovative but also have scalable solutions that can address large-scale environmental or social challenges.

- Management Commitment: Assess whether sustainability is integrated into the company’s core strategy and leadership vision, indicating a long-term commitment.

- Regulatory Landscape: Understand how current and future regulations might impact the company’s operations and competitive advantage in the sustainable sector.

Furthermore, diversification across different sustainable sectors can help mitigate risks and enhance overall portfolio resilience. Spreading investments across renewable energy, circular economy, and sustainable agriculture, for instance, can capture growth from various facets of the green economy.

In essence, navigating the sustainable investment landscape requires a blend of financial acumen and a deep understanding of environmental and social impacts. By focusing on robust ESG performance and innovative solutions, investors can unlock significant value and contribute positively to a sustainable future.

Impact of Policy and Regulation on Green Investments

Government policies and regulatory frameworks play a pivotal role in shaping the landscape for green investments in the U.S. They can either accelerate or hinder the adoption of sustainable practices and the growth of green industries. Understanding the current and anticipated policy environment is therefore crucial for investors looking to capitalize on sustainable business trends.

Supportive policies, such as tax incentives for renewable energy, grants for sustainable agriculture, and regulations promoting circular economy principles, create a more favorable business environment for green companies. Conversely, a lack of clear policy or inconsistent regulations can introduce uncertainty, affecting investment flows and project development.

Key Policy Drivers for Sustainable Growth

Several policy initiatives are expected to significantly influence sustainable investment opportunities in the U.S. by 2025. These drivers are designed to foster innovation and accelerate the transition to a greener economy.

- Inflation Reduction Act (IRA): This landmark legislation provides substantial tax credits and incentives for clean energy production, electric vehicles, and energy efficiency, driving massive investment into these sectors.

- State-Level Initiatives: Many U.S. states are enacting their own ambitious renewable energy mandates, carbon pricing mechanisms, and sustainable procurement policies, creating diverse regional investment opportunities.

- ESG Disclosure Requirements: Increasing pressure from regulators and stakeholders for companies to disclose their ESG performance will enhance transparency and direct capital towards more sustainable entities.

- Infrastructure Investments: Federal funding for modernizing infrastructure often includes provisions for green technologies, such as smart grids, electric vehicle charging networks, and sustainable public transportation.

These policies not only de-risk green investments but also create new markets and demand for sustainable products and services. Companies that are adept at navigating and leveraging these policy tailwinds are likely to see accelerated growth and enhanced profitability.

In conclusion, the interplay between policy and green investments cannot be overstated. Investors who monitor and understand these regulatory shifts will be better positioned to identify and exploit the most promising opportunities within the sustainable business trends, ensuring robust returns and long-term success.

Future Outlook: Beyond 2025 for Sustainable Returns

While our focus has been on 2025, the trajectory of sustainable business trends in the U.S. extends far beyond, promising even greater opportunities for long-term investors. The foundational shifts occurring now in renewable energy, circular economy, and sustainable agriculture are not temporary fads but fundamental transformations that will continue to redefine industries for decades to come.

The increasing urgency of climate change, coupled with technological advancements and evolving consumer consciousness, ensures that sustainability will remain a central theme in economic development. Investors who adopt a long-term perspective will find that commitments to ESG principles are not just about mitigating risks but about unlocking enduring value and resilience.

Emerging Technologies and New Frontiers

The pace of innovation in sustainable technologies shows no signs of slowing down. Beyond the current trends, new frontiers are continually opening up, presenting fresh investment avenues.

- Carbon Capture and Utilization: Technologies that not only capture carbon emissions but also convert them into valuable products are gaining significant attention and investment.

- Green Hydrogen: As a clean energy carrier, green hydrogen produced from renewable sources is poised to revolutionize heavy industry, transportation, and energy storage.

- Biodiversity and Ecosystem Services: Investment in natural capital, such as reforestation, wetland restoration, and sustainable land management, is emerging as a crucial area for both ecological and financial returns.

- Sustainable Finance Innovations: New financial instruments and platforms specifically designed to fund green projects and sustainable businesses are making it easier for capital to flow into these sectors.

These emerging areas underscore the dynamic nature of sustainable investing, offering a continuous stream of opportunities for those willing to explore and innovate. The long-term outlook for sustainable returns is immensely positive, driven by a global imperative to transition to a greener, more resilient economy.

Ultimately, investing in sustainable business trends is about more than just financial gain; it’s about contributing to a future that is both prosperous and planet-friendly. By looking beyond 2025 and embracing the ongoing evolution of green markets, investors can achieve significant returns while making a tangible positive impact on the world.

| Key Sustainable Trend | Brief Description |

|---|---|

| Renewable Energy | Advancements in solar, wind, and energy storage technologies driving clean power generation and grid stability. |

| Circular Economy | Innovations in waste-to-value, advanced recycling, and product life cycle management reducing waste and maximizing resource utility. |

| Sustainable Agriculture | Precision farming, alternative proteins, and resource-efficient food systems ensuring food security and environmental protection. |

| Policy & Regulation Support | Government incentives and mandates (e.g., IRA) accelerating green investments and market growth. |

Frequently Asked Questions About Sustainable Business Trends

The primary drivers include increasing consumer demand for eco-friendly products, stringent government regulations and incentives (like the Inflation Reduction Act), rapid technological advancements making sustainable solutions more viable, and a growing understanding among investors of the financial risks associated with non-sustainable practices.

Renewable energy advancements offer returns through declining costs of production, increased efficiency of solar and wind technologies, and innovations in energy storage solutions. Government subsidies and a growing demand for clean power also ensure consistent revenue streams and market expansion for leading companies in this sector.

The circular economy creates investment opportunities by transforming waste into valuable resources, promoting advanced recycling, and extending product lifecycles. Companies innovating in waste-to-value processes, sustainable material development, and product-as-a-service models are poised for significant growth as industries seek to reduce environmental impact and improve resource efficiency.

No, sustainable agriculture investments are not exclusive to large corporations. While big players are involved, there are ample opportunities for smaller businesses and investors in areas like precision agriculture technology, urban farming initiatives, organic food production, and alternative protein startups, which often require less capital and offer high growth potential.

Investors can evaluate authenticity by scrutinizing ESG reports, looking for third-party certifications, examining transparent supply chains, and assessing whether sustainability is integrated into the company’s core business strategy and governance. Avoid companies with vague claims and prioritize those with measurable goals and verifiable impacts.

Conclusion

The U.S. investment landscape is undeniably shifting, with sustainable business trends emerging as powerful engines for future growth and profitability. The deep dive into renewable energy advancements, circular economy innovations, and sustainable agriculture reveals not just environmental imperatives but compelling opportunities for significant investor returns by 2025. These sectors, bolstered by supportive policies and increasing consumer demand, are at the forefront of a global transformation towards a more resilient and sustainable economy. For discerning investors, aligning portfolios with these trends offers a strategic pathway to both financial success and positive societal impact, positioning them at the vanguard of the next wave of economic prosperity.