Geopolitical Events Impacting US Business: An Expert Analysis

Expert analysis reveals that geopolitical events significantly influence the US business landscape, affecting investment strategies, supply chains, and market volatility.

The U.S. business landscape is constantly evolving, shaped by a complex interplay of factors. Among the most influential are geopolitical events, which can have far-reaching consequences on investment decisions, supply chain stability, and overall market volatility. Understanding the impact of geopolitical events on the US business landscape is crucial for businesses to navigate these uncertain times.

Understanding Geopolitical Risks and the US Economy

Geopolitical risks represent uncertainties stemming from political, social, and military events across the globe. These risks can manifest as trade wars, political instability, armed conflicts, and international sanctions, each posing unique challenges to the U.S. economy.

Defining Geopolitical Risk

Geopolitical risk encompasses any risk that arises from the political and military actions, social unrest, and terroristic acts which affect any country. This risk is highly interconnected, with events in one region often having ripple effects worldwide.

Channels of Impact on the US Economy

The impact on the U.S. economy is multi-faceted. Trade is affected through tariffs and trade barriers, investment becomes cautious due to instability, and financial markets react to uncertainty. Geopolitical instability can lead to higher energy prices, impacting inflation and consumer spending.

- Trade disruptions due to new tariffs or trade wars can significantly alter supply chains.

- Fluctuations in the price of commodities can lead to inflationary pressures in the U.S.

- Uncertainty can lead to decreased foreign direct investment into the U.S. economy.

- Sanctions against other nations can reduce demand for U.S. exports.

In conclusion, understanding geopolitical risks is essential for U.S. businesses to effectively manage their strategies and operations. Identifying channels of impact can help mitigate possible risks and make better-informed business decisions.

How Trade Wars and Protectionism Affect US Businesses

Trade wars and protectionist policies have direct and indirect effects on U.S. businesses. These actions can lead to increased costs, altered supply chains, and shifts in consumer behavior that can significantly impact profitability and growth.

Direct Effects of Trade Wars

When countries impose tariffs on each other’s goods, U.S. businesses importing raw materials or exporting finished products face increased costs. Tariffs raise the price of goods, making them less competitive in the global market. This can decrease sales and reduce profits for U.S. companies.

Indirect Effects on Supply Chains

Beyond immediate cost increases, trade wars can disrupt established supply chains. Companies may need to find new suppliers or relocate production facilities to avoid tariffs. This process is often costly and time-consuming, adding to operational challenges.

Strategies for Businesses to Adapt

U.S. businesses have several strategies to adapt to trade wars and protectionist measures. Diversifying supply chains, exploring domestic sourcing options, and negotiating with suppliers are all viable approaches. Additionally, companies may need to adjust their pricing strategies to remain competitive.

- Diversifying supply chains to reduce reliance on single sources.

- Exploring domestic sourcing of materials and components to avoid tariffs.

- Hedging strategies to manage currency risks associated with international trade.

- Investing in automation to improve efficiency and reduce production costs.

Trade wars and protectionist policies can have severe implications for the U.S. business landscape. By understanding the direct and indirect effects and implementing proactive strategies, businesses can navigate these challenges and maintain their competitiveness.

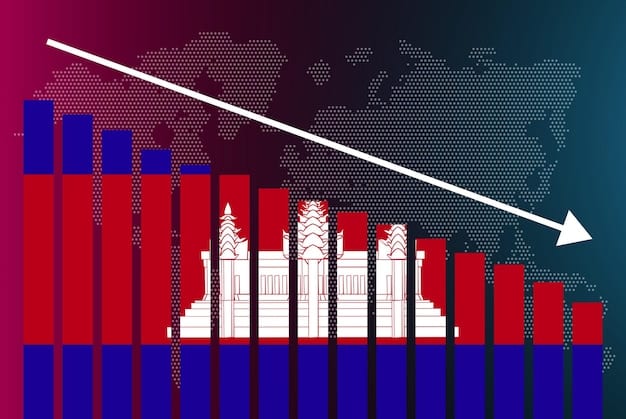

The Impact of Political Instability on Investment Decisions

Political instability refers to abrupt and unpredictable changes in a country’s political climate. These changes can include government overthrows, civil unrest, policy shifts, and regulatory uncertainty, all of which significantly impact investment decisions.

Defining Political Instability

Political instability is characterized by the unpredictability of the political environment. This can manifest through corruption, lack of rule of law, and frequent changes in government policies.

How Instability Deters Investment

Investors typically seek stable and predictable environments to protect their capital. Political instability creates uncertainty, making it difficult to assess future returns and manage risks. Consequently, investors may delay or cancel investments in unstable regions, redirecting capital to more secure markets.

Case Studies of Investment Decline

Several case studies illustrate how political instability deters investment. Countries experiencing civil wars or political coups often see a sharp decline in foreign direct investment. For example, regions with ongoing security threats or corruption issues typically struggle to attract long-term investments.

Political instability undermines investor confidence, leading to decreased investment. This reduction can have long-term consequences, hindering economic growth and development. The need for stable governance and rule of law is critical for attracting investment and supporting sustainable economic activity.

Cybersecurity Threats and Their Economic Consequences

In today’s digital age, cybersecurity threats pose significant economic risks to U.S. businesses. Cyberattacks can disrupt operations, compromise sensitive data, and lead to substantial financial losses. Businesses must understand these threats and invest in robust security measures to protect their assets.

Understanding Cybersecurity Risks

Cybersecurity risks include a wide range of malicious activities, such as ransomware attacks, data breaches, and denial-of-service attacks. These threats can originate from various sources, including organized criminal groups, state-sponsored actors, and individual hackers.

Economic Consequences of Cyberattacks

The economic consequences of cyberattacks can be severe. Businesses may incur direct costs related to incident response, data recovery, and legal settlements. Additionally, reputational damage can lead to loss of customers and revenue. Indirect costs include downtime, productivity losses, and increased insurance premiums.

Strategies for Protecting Businesses

To protect against cybersecurity threats, businesses should implement comprehensive security strategies. These strategies include investing in advanced security technologies, conducting regular security audits, training employees on cybersecurity best practices, and developing incident response plans.

- Implementing multi-factor authentication to protect against unauthorized access.

- Regularly updating software and systems to patch security vulnerabilities.

- Conducting phishing awareness campaigns to educate employees about email scams.

- Developing and testing incident response plans to minimize the impact of attacks.

Cybersecurity threats pose a significant economic risk to U.S. businesses. By understanding these risks and adopting proactive security measures, businesses can mitigate potential losses and maintain their competitive edge in the digital era.

The Role of Sanctions in Shaping US Business Opportunities

Sanctions are economic tools used by the U.S. government to influence the behavior of other countries. While sanctions can serve important geopolitical objectives, they also have notable implications for U.S. businesses. Understanding the role of sanctions is vital for navigating international markets.

How Sanctions Work

Sanctions typically involve restrictions on trade, investment, and financial transactions with targeted countries or entities. These restrictions can take various forms, including embargoes, asset freezes, and travel bans.

Impact on US Businesses

Sanctions can create both challenges and opportunities for U.S. businesses. On one hand, they may restrict access to certain markets, limiting export and investment opportunities. On the other hand, sanctions can create new opportunities in alternative markets or industries.

Navigating Sanctioned Markets

Businesses operating in sanctioned markets must comply with complex regulatory requirements. This includes conducting due diligence to ensure compliance with sanctions laws and avoiding prohibited transactions. Seeking guidance from legal experts and regulatory agencies is crucial for navigating these markets.

Sanctions play a significant role in shaping U.S. business opportunities. By understanding how sanctions work and their potential impact, businesses can make informed decisions about their international operations and manage risks effectively.

Expert Opinions on Future Geopolitical Trends and Business Strategy

Predicting future geopolitical trends is challenging, but expert analysis can provide valuable insights for businesses. By staying informed about potential geopolitical developments and their implications, businesses can develop robust strategies to navigate uncertainty.

Insights from Geopolitical Experts

Geopolitical experts emphasize the importance of monitoring global trends, such as shifts in political power, emerging security threats, and economic imbalances. These trends can provide leading indicators of potential geopolitical events that may impact businesses.

Developing Resilient Business Strategies

To build resilience, businesses should adopt flexible and adaptable strategies. This includes diversifying markets, strengthening supply chains, and investing in risk management capabilities. By preparing for a range of scenarios, businesses can minimize the impact of adverse geopolitical events.

The Importance of Scenario Planning

Scenario planning involves developing multiple plausible scenarios for the future and assessing their potential impact on the business. This approach enables businesses to anticipate risks and opportunities and develop appropriate response strategies.

- Conducting regular risk assessments to identify potential geopolitical threats.

- Developing contingency plans to address various geopolitical scenarios.

- Investing in intelligence gathering to stay informed about emerging trends.

- Building relationships with government agencies and industry partners to enhance resilience.

Staying informed and proactive can help businesses thrive amidst global uncertainty. Expert opinions and insights can guide businesses in developing resilient strategies and navigating geopolitical risks effectively.

| Key Aspect | Brief Description |

|---|---|

| ⚠️ Geopolitical Risks | Political, social, and military events impacting the economy. |

| ⚔️ Trade Wars | Increased costs and supply chain disruptions due to tariffs. |

| 📉 Political Instability | Deters investment due to unpredictable political changes. |

| 🛡️ Cybersecurity | Cyber threats and data breaches cause significant economic losses. |

Frequently Asked Questions

▼

Primary risks include trade wars, political instability, cybersecurity threats, and the influence of sanctions. These factors impact supply chains, investment decisions, and market volatility.

▼

Trade wars increase costs for imported goods, disrupt supply chains, and make U.S exports less competitive. This can lead to reduced sales and decreased profit margins.

▼

Diversifying markets, strengthening supply chains, and investing in risk management are crucial. Developing contingency plans for a range of scenarios is also beneficial.

▼

Cyberattacks can disrupt operations, compromise sensitive data, and result in substantial financial losses. Reputational damage and legal settlements further contribute to economic consequences.

▼

Compliance with regulatory requirements is essential. Conduct thorough due diligence, avoid prohibited transactions, and consult legal experts. Monitor regulatory changes to adapt to evolving sanctions.

Conclusion

In conclusion, geopolitical events are a significant force shaping the US business landscape. By understanding these influences and developing adaptive strategies, businesses can effectively manage risks and capitalize on emerging opportunities amid global uncertainty. Staying informed, diversifying, and building resilience are vital for sustained success.